Agrium Inc. ( AGU ) recently cut full year earnings guidance as crop prices stay in the cellar. This Zacks Rank #5 (Strong Sell) is expected to see a double digit earnings decline in 2016.

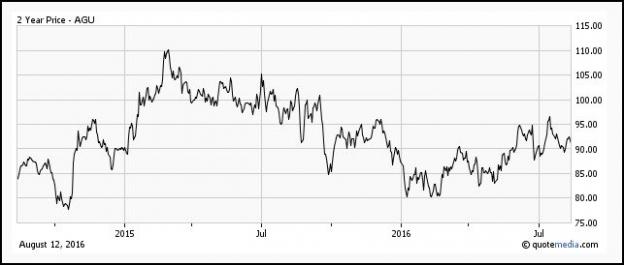

Agrium produces all three major fertilizers, including nitrogen, phosphates and potash. It is also a retail supplier of agricultural products such as crop protection and seeds in North America, South America and Australia. It’s headquartered in Calgary. A Second Quarter Beat But… On Aug 3, Agrium reported its second quarter earnings and actually beat the Zacks Consensus Estimate by 4 cents. Earnings were $ 4.09 compared to the Zacks Consensus of $ 4.05. The good news was that the retail side of the business is doing well. The earnings were the second highest in history due to strong margins and lower costs. Agrium acquired 33 retail locations with expected annual sales in excess of $ 230 million. It’s also working on the 18-store deal with Cargill and another deal which would add 12 more locations. These deals represent another $ 300 million in expected sales. What’s the bad news? Crop prices remain at multi-year lows which means farmers aren’t buying as much product. Fertilizer prices, including potash and nitrogen, also both remain weak. Additionally, rising natural gas prices will mean tighter margins on the nitrogen side. Guidance Cut Agrium cut its full year guidance to a range of $ 5.00 to $ 5.35 from its prior guidance of $ 5.25 to $ 6.25. It’s original guidance for 2016 had a high range of $ 7.00, so you can see just how tough the fertilizer industry has gotten over the past year. Potash prices are expected to bottom by the end of the year, however. Given the guidance cut, analysts had to cut full year estimates to get in line. 2 estimates have been cut in the last week for 2016. The 2016 Zacks Consensus Estimate fell to $ 5.26 from $ 5.86 just 90 days ago. That’s a 25% drop in earnings from 2015 when the company earned $ 6.99. Are Shares Cheap? Given the gloomy outlook for the fertilizer industry, in the near term, it’s surprising that Agrium shares have held up fairly well over the last 2 years. They aren’t trading anywhere near their 2-year lows.  Agrium is considered to be more diverse than the other pure fertilizer companies, because of its retail business, so investors appear more willing to pay a premium for that diversity. Shares are trading with a forward P/E of 17.5. That’s not cheap. Investors do get a dividend, currently yielding a healthy 3.8%. Is the dividend safe? The company says it has “sufficient current assets” to meet its liabilities. There’s really nowhere to hide out in the fertilizer space right now. All of the big fertilizer companies like Mosaic ( MOS ) and CF Industries ( CF ) have Zacks Ranks of #5 (Strong Sells) because their estimates have been slashed. Remember, the Zacks Rank is a short term recommendation. With the fertilizers, investors will need a longer time horizon. Is this an industry you might want to consider shorting? Find out tips on shorting stocks in our podcast. The fertilizers are one commodity, unlike oil and even iron ore, that haven’t yet seen any recovery. More Stocks to Sell. Now. Beyond our Bear Stock of the Day, today’s list of 220 Zacks Rank #5 Strong Sells demand even more urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. Many appear to be sound investments but, since 1988, such stocks have actually performed more than 11X worse than the S&P 500. See today’s Zacks “”Strong Sells”” absolutely free >>.

Agrium is considered to be more diverse than the other pure fertilizer companies, because of its retail business, so investors appear more willing to pay a premium for that diversity. Shares are trading with a forward P/E of 17.5. That’s not cheap. Investors do get a dividend, currently yielding a healthy 3.8%. Is the dividend safe? The company says it has “sufficient current assets” to meet its liabilities. There’s really nowhere to hide out in the fertilizer space right now. All of the big fertilizer companies like Mosaic ( MOS ) and CF Industries ( CF ) have Zacks Ranks of #5 (Strong Sells) because their estimates have been slashed. Remember, the Zacks Rank is a short term recommendation. With the fertilizers, investors will need a longer time horizon. Is this an industry you might want to consider shorting? Find out tips on shorting stocks in our podcast. The fertilizers are one commodity, unlike oil and even iron ore, that haven’t yet seen any recovery. More Stocks to Sell. Now. Beyond our Bear Stock of the Day, today’s list of 220 Zacks Rank #5 Strong Sells demand even more urgent attention. If any are lurking in your portfolio or Watch List, they should be removed immediately. Many appear to be sound investments but, since 1988, such stocks have actually performed more than 11X worse than the S&P 500. See today’s Zacks “”Strong Sells”” absolutely free >>.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MOSAIC CO/THE (MOS): Free Stock Analysis Report

CF INDUS HLDGS (CF): Free Stock Analysis Report

AGRIUM INC (AGU): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International