Agnico Eagle Mines Limited AEM reported a net income of $ 62.7 million or 28 cents per share in the fourth quarter of 2016, compared with net loss of $ 15.5 million or 7 cents per share recorded in the year-ago quarter.

Adjusted earnings came in at 2 cents per share in the fourth quarter, missing the Zacks Consensus Estimate of 4 cents.

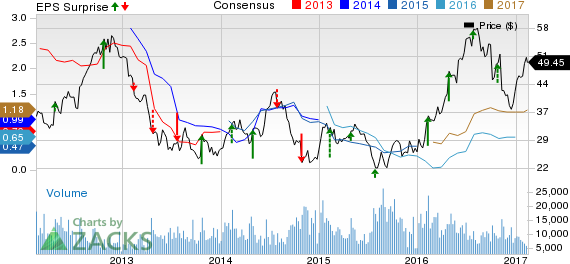

Agnico Eagle Mines Limited Price, Consensus and EPS Surprise

Agnico Eagle Mines Limited Price, Consensus and EPS Surprise | Agnico Eagle Mines Limited Quote

Revenues and Operational Highlights

Agnico Eagle registered revenues of $ 499 million in fourth quarter of 2016, up 3.3% from $ 483 million in the year-ago quarter. The figure missed the Zacks Consensus Estimate of $ 538 million.

Payable gold production in the fourth quarter inched up 0.9% year over year to 426,433 ouncesfrom 422,328 ounces in the year-ago quarter.

Total cash costs per ounce for the fourth quarter of 2016 were $ 552, up from the $ 547 per ounce for the fourth quarter of 2015.

All-in sustaining costs per ounce (AISC) were $ 824 for 2016, lower than the guidance of between $ 840 and $ 880. This is mainly due to lower-than-expected total cash costs per ounce in 2016 and higher-than-expected production.

Financial Position

As of Dec 31, 2016, cash and cash equivalents were around $ 540 million, up four-fold year over year. Net debt was lowered by $ 346 million in 2016, further reinforcing the company’s investment grade balance sheet

There was no outstanding balance on Agnico Eagle’s credit facility as of Dec 31, 2016. This results in available credit lines of roughly $ 1.2 billion, excluding the uncommitted $ 300 million accordion feature.

Total capital expenditures in the reported quarter were $ 156.3 million.

The company’s board has declared a quarterly cash dividend of 10 cents per common share, payable on March 15 to shareholders of record as of Mar 1, 2017.

Outlook

Agnico Eagle expects total cash costs to be between $ 595 and $ 625 and AISC to be between $ 850 and $ 900 per ounce in 2017. The company expects total cash costs per ounce and AISC to be below the 2017 ranges in the coming years.

Total capital expenditures are expected to be approximately $ 850 million in 2017. Agnico Eagle foresees 2017 general and administration expense to be between $ 70 and $ 80 million, excluding share based compensation. The company’s overall tax rate is anticipated to be between 40% and 45%.

Price Performance

Agnico Eagle has underperformed the Mining-Gold industry in the past three months. The company’s shares have gained 15.4% over this period compared with the industry’s gain of 18.2%.

Zacks Rank & Key Picks

Agnico Eagle currently carries a Zacks Rank #3 (Hold).

Some better-ranked companies in the basic material space include Intrepid Potash Inc IPI , Pershing Gold Corp. PGLC and Albemarle Corp. ALB .

Intrepid Potash Inc has an expected earnings growth of 57.7% for the current year and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Pershing Gold holds a Zacks Rank #2 and has an expected earnings growth of 98% for the current year.

Albemarle holds a Zacks Rank #2 (Buy) and has an expected long-term growth of 10%.

Just Released – Driverless Cars: Your Roadmap to Mega-Profits Today

In this latest Special Report, Zacks’ Aggressive Growth Strategist Brian Bolan explores a full-blown technological breakthrough in the making – autonomous cars. He also spotlights 8 stocks with tremendous gain potential to feed off this phenomenon. Click to see the stocks right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Albemarle Corporation (ALB): Free Stock Analysis Report

Intrepid Potash, Inc (IPI): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Pershing Gold Corporation (PGLC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International