Scalper1 News

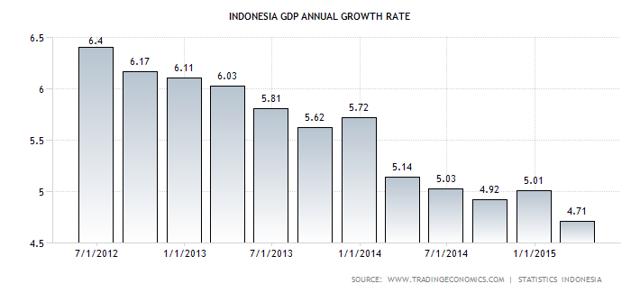

Summary Indonesia is on track for future economic growth, as GDP Growth and consumer spending are both projected to substantially increase. The Aberdeen Indonesia Fund is the most attractively valued fund, and provides exposure to strong companies in the banking and consumer products industries. The main risks of investing in Indonesia include exchange rate movements, inflation, and relatively high valuation of the consumer products industry; apart from this, invest looks very favorable. The Aberdeen Indonesia Fund is potentially the best way to gain exposure to Indonesia’s future growth. Emerging Indonesia is clearly on track for considerable future growth in 2015 and 2016, as the Asian Development Bank has projected GDP Growth of 6.4% and 6.3% in 2015 and 2016 respectively. Moreover, Indonesia’s president has set a target GDP growth of 7% for 2017 , as infrastructure development and foreign direct investment are expected to attribute to this growth. Future growth in Indonesia’s economy, in multiple industries, provides the opportunity for investors to profit off of the current setback. However, Exchange Traded Funds are not allows an accurate reflection of a country’s performance, and choosing the appropriate vehicle is crucial. Based on an examination of valuation, I have decided that the Aberdeen Indonesia Fund (NYSEMKT: IF ) is the most appropriate fund for investors who wish to profit from Indonesia’s growth. The Aberdeen Indonesia fund is a closed end fund, and has the comparative advantage of having lower valuation than Indonesian Exchange Traded Funds. Moreover, its liquidity looks very favorable, as its average trading volume is 18,579 . The fund currently has a P/E ratio of 8.8 , which is considerably lower than other alternatives; the Market Vectors Indonesia Index ETF (NYSEARCA: IDX ) has a P/E ratio of 16 and the iShares MSCI Indonesia ETF (NYSEARCA: EIDO ) currently has a P/E ratio of 12 . Another key advantage of this fund is its Beta of 0.78, making it less volatile in the market. Although the fund has had a 1 year return of -20.86% , an assessment of Indonesia’s economy and respective industries of the fund’s holdings provides a favorable outlook; its current valuation and past performance should merely be viewed as an opportunity to buy while it is low. The price of the fund has been on a sharp decline, which can mainly be attributed to its slowed GDP growth, which is expected to recover. An assessment of the performance of the fund’s main holdings further attributes to the logic of having a bullish outlook of Indonesia, specifically through this fund. Macroeconomic Outlook Examining Indonesia’s past macroeconomic performance, particularly in 2012, it is clear that a rebound in the country’s growth is highly feasible. The country is on track for recovery from the currently slowed GDP growth of 4.7, and will return to the higher growth experienced in 2012. If growth goes as anticipated up to 2017, Indonesia will be able to surpass its economic performance in 2012. (click to enlarge) Source(Trading Economics) Inflation is another struggle in Indonesia, that has a more positive outlook for 2015 and 2016. The country’s finance minister projected that inflation rates would fall to 4.5-5% in 2015, representing recovery and a return to levels in late 2014. However, 2015 has so far only produced slight recovery from the inflation rate during the beginning of 2015. (click to enlarge) Source(Trading Economics) 2015 has also witnessed a significant improvement of the country’s balance of trade, as the country began to have a trade surplus in 2015. The turnaround in 2015 is attributed increased economic growth and the recovery of commodity prices; with further growth projected for 2015 and 2016, Indonesia’s trade surplus certainly has room for increase. (click to enlarge) Source(Trading Economics) Positive Overall Outlook Combined with FX/Inflation Risks Investment into Indonesia overall looks very favorable, especially into a fund with very low valuation. Indonesia is on track for recovery in GDP Growth, and its balance of trade has drastically improved in 2015. Areas of concern for investors include inflation, which is expected to improve to conditions in 2014. Since 2015, the Indonesia Rupiah has fluctuated approximately between 12,500 and 13,400, stabilizing at 13,332 in June of 2015. The rupiah has been the worst performing currency in Asia, and in December the Rupiah hit its lowest since the economic crisis 1978-1979 Asian Financial Crisis. I believe that the low valuation of the fund, increased GDP growth, and improved balance of trade are strong enough to counter the inflation and currency risks. Moreover, the financial performance of the fund’s holdings has been very impressive, considering the issues of inflation and slowed economic growth. Fund Holdings The fund mainly invests into the banking and consumer products industries, while one of the holdings operates in the construction industry. Banking Industry An observations of the fund’s holdings in this industry produces a favorable outcome, with attractive valuation and financial performance. The average P/E ratio for the top holdings in this industry is 13.6, which is substantially lower than the average P/E ratio of 21.89 of the Jarkata Stock Exchange Composite Index. The average growth in net revenue for 2014 was 11.8% The average growth in net income for 2014 was 8.1% Overall the growth was not very strong, but is still relatively impressive, considering that this industry was able to achieve growth despite the country’s decrease in GDP growth. With attractive valuation, and increased growth projected in the future, this industry can be considered a strength of the fund’s holdings. Despite excellent financial performance and attractive valuation, a survey from PWC characterizes the industry in 2015 as being volatile and uncertain, along with progression in a variety of areas. Loan growth is projected to grow around 10% to 20% in 2015, mainly driven by Small and Medium Enterprise growth. Credit, Liquidity, and Operational risk remain major threats for banks, which can be offset by enhancing the processes of monitoring and distributing loans, as well as limiting exposure to high risk industries. Banks will catalyze the projected growth in infrastructure, although it is only estimated to be less than 10% of its portfolio. Bankers stated that the Rupiah exchange rate will continue to be under pressure, but expects inflation to continue easing. Despite uncertainty ahead, particularly regarding exchange rate movements, the banking industry has multiple positive outlooks, and the specific holdings of this CEF are very attractive. Consumer Products Consumer spending has been on a consistent rise since 2012, attributed to the high performance of this industry and the fund’s holdings. The lag in GDP growth did not hinder growth in consumer spending, and with increased GDP growth projected for 2015 and 2016, the future outlook for this industry is very favorable. Consumer spending is projected to increase to 1,231,249 by the 2nd quarter of 2016, and to 1,243,356 by 2020. There is still room for growth in this industry, although growth will slow by 2016; although entering in 2012 would have been most strategic, there is certainly room for profit in the current environment. (click to enlarge) Source(Trading Economics) Eyes have already been on Indonesia as a destination for the consumer products industry. Euromonitor calculated in 2014 that Indonesia will gain 80 million new consumers , accounting for 40% of new consumers in the ASEAN region. Strong growth is clearly ahead for this industry, which may provide suitable justification for the valuation of the holdings in this industry: The average P/E ratio for the holdings in this industry is 31.2, which is not very attractive for an emerging market. However, the high potential for future growth, combined the projected GDP growth, is substantial enough to justify this valuation. Net Income increased by 28.6% in 2014, while net revenue increased by 11.5%; these companies are an accurate reflection of the industry’s growth. Conclusion Indonesia certainly holistically presents itself as an attractive investment opportunity, with the Aberdeen Indonesia Fund being an appropriate vehicle. For those wishing to navigate the acceptable amounts of risk presented, the opportunity for profit is incredibly feasible due to Indonesia’s projected growth, the overall favorable outlook of the banking and consumer products industry, and the attractive valuation of the Aberdeen Indonesia Fund. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Indonesia is on track for future economic growth, as GDP Growth and consumer spending are both projected to substantially increase. The Aberdeen Indonesia Fund is the most attractively valued fund, and provides exposure to strong companies in the banking and consumer products industries. The main risks of investing in Indonesia include exchange rate movements, inflation, and relatively high valuation of the consumer products industry; apart from this, invest looks very favorable. The Aberdeen Indonesia Fund is potentially the best way to gain exposure to Indonesia’s future growth. Emerging Indonesia is clearly on track for considerable future growth in 2015 and 2016, as the Asian Development Bank has projected GDP Growth of 6.4% and 6.3% in 2015 and 2016 respectively. Moreover, Indonesia’s president has set a target GDP growth of 7% for 2017 , as infrastructure development and foreign direct investment are expected to attribute to this growth. Future growth in Indonesia’s economy, in multiple industries, provides the opportunity for investors to profit off of the current setback. However, Exchange Traded Funds are not allows an accurate reflection of a country’s performance, and choosing the appropriate vehicle is crucial. Based on an examination of valuation, I have decided that the Aberdeen Indonesia Fund (NYSEMKT: IF ) is the most appropriate fund for investors who wish to profit from Indonesia’s growth. The Aberdeen Indonesia fund is a closed end fund, and has the comparative advantage of having lower valuation than Indonesian Exchange Traded Funds. Moreover, its liquidity looks very favorable, as its average trading volume is 18,579 . The fund currently has a P/E ratio of 8.8 , which is considerably lower than other alternatives; the Market Vectors Indonesia Index ETF (NYSEARCA: IDX ) has a P/E ratio of 16 and the iShares MSCI Indonesia ETF (NYSEARCA: EIDO ) currently has a P/E ratio of 12 . Another key advantage of this fund is its Beta of 0.78, making it less volatile in the market. Although the fund has had a 1 year return of -20.86% , an assessment of Indonesia’s economy and respective industries of the fund’s holdings provides a favorable outlook; its current valuation and past performance should merely be viewed as an opportunity to buy while it is low. The price of the fund has been on a sharp decline, which can mainly be attributed to its slowed GDP growth, which is expected to recover. An assessment of the performance of the fund’s main holdings further attributes to the logic of having a bullish outlook of Indonesia, specifically through this fund. Macroeconomic Outlook Examining Indonesia’s past macroeconomic performance, particularly in 2012, it is clear that a rebound in the country’s growth is highly feasible. The country is on track for recovery from the currently slowed GDP growth of 4.7, and will return to the higher growth experienced in 2012. If growth goes as anticipated up to 2017, Indonesia will be able to surpass its economic performance in 2012. (click to enlarge) Source(Trading Economics) Inflation is another struggle in Indonesia, that has a more positive outlook for 2015 and 2016. The country’s finance minister projected that inflation rates would fall to 4.5-5% in 2015, representing recovery and a return to levels in late 2014. However, 2015 has so far only produced slight recovery from the inflation rate during the beginning of 2015. (click to enlarge) Source(Trading Economics) 2015 has also witnessed a significant improvement of the country’s balance of trade, as the country began to have a trade surplus in 2015. The turnaround in 2015 is attributed increased economic growth and the recovery of commodity prices; with further growth projected for 2015 and 2016, Indonesia’s trade surplus certainly has room for increase. (click to enlarge) Source(Trading Economics) Positive Overall Outlook Combined with FX/Inflation Risks Investment into Indonesia overall looks very favorable, especially into a fund with very low valuation. Indonesia is on track for recovery in GDP Growth, and its balance of trade has drastically improved in 2015. Areas of concern for investors include inflation, which is expected to improve to conditions in 2014. Since 2015, the Indonesia Rupiah has fluctuated approximately between 12,500 and 13,400, stabilizing at 13,332 in June of 2015. The rupiah has been the worst performing currency in Asia, and in December the Rupiah hit its lowest since the economic crisis 1978-1979 Asian Financial Crisis. I believe that the low valuation of the fund, increased GDP growth, and improved balance of trade are strong enough to counter the inflation and currency risks. Moreover, the financial performance of the fund’s holdings has been very impressive, considering the issues of inflation and slowed economic growth. Fund Holdings The fund mainly invests into the banking and consumer products industries, while one of the holdings operates in the construction industry. Banking Industry An observations of the fund’s holdings in this industry produces a favorable outcome, with attractive valuation and financial performance. The average P/E ratio for the top holdings in this industry is 13.6, which is substantially lower than the average P/E ratio of 21.89 of the Jarkata Stock Exchange Composite Index. The average growth in net revenue for 2014 was 11.8% The average growth in net income for 2014 was 8.1% Overall the growth was not very strong, but is still relatively impressive, considering that this industry was able to achieve growth despite the country’s decrease in GDP growth. With attractive valuation, and increased growth projected in the future, this industry can be considered a strength of the fund’s holdings. Despite excellent financial performance and attractive valuation, a survey from PWC characterizes the industry in 2015 as being volatile and uncertain, along with progression in a variety of areas. Loan growth is projected to grow around 10% to 20% in 2015, mainly driven by Small and Medium Enterprise growth. Credit, Liquidity, and Operational risk remain major threats for banks, which can be offset by enhancing the processes of monitoring and distributing loans, as well as limiting exposure to high risk industries. Banks will catalyze the projected growth in infrastructure, although it is only estimated to be less than 10% of its portfolio. Bankers stated that the Rupiah exchange rate will continue to be under pressure, but expects inflation to continue easing. Despite uncertainty ahead, particularly regarding exchange rate movements, the banking industry has multiple positive outlooks, and the specific holdings of this CEF are very attractive. Consumer Products Consumer spending has been on a consistent rise since 2012, attributed to the high performance of this industry and the fund’s holdings. The lag in GDP growth did not hinder growth in consumer spending, and with increased GDP growth projected for 2015 and 2016, the future outlook for this industry is very favorable. Consumer spending is projected to increase to 1,231,249 by the 2nd quarter of 2016, and to 1,243,356 by 2020. There is still room for growth in this industry, although growth will slow by 2016; although entering in 2012 would have been most strategic, there is certainly room for profit in the current environment. (click to enlarge) Source(Trading Economics) Eyes have already been on Indonesia as a destination for the consumer products industry. Euromonitor calculated in 2014 that Indonesia will gain 80 million new consumers , accounting for 40% of new consumers in the ASEAN region. Strong growth is clearly ahead for this industry, which may provide suitable justification for the valuation of the holdings in this industry: The average P/E ratio for the holdings in this industry is 31.2, which is not very attractive for an emerging market. However, the high potential for future growth, combined the projected GDP growth, is substantial enough to justify this valuation. Net Income increased by 28.6% in 2014, while net revenue increased by 11.5%; these companies are an accurate reflection of the industry’s growth. Conclusion Indonesia certainly holistically presents itself as an attractive investment opportunity, with the Aberdeen Indonesia Fund being an appropriate vehicle. For those wishing to navigate the acceptable amounts of risk presented, the opportunity for profit is incredibly feasible due to Indonesia’s projected growth, the overall favorable outlook of the banking and consumer products industry, and the attractive valuation of the Aberdeen Indonesia Fund. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News