Bayer AG ‘s BAYRY second-quarter core earnings increased 4% year over year to €2.07 per share (approximately $ 2.34 per share). Core earnings of $ 2.34 per share significantly beat the Zacks Consensus Estimate of $ 2.19.

However, total sales fell 1.4% to €11.8 billion (approximately $ 13.4 billion) on a reported basis in the second quarter of 2016, but increased 2.3% after adjusting for currency and portfolio effects primarily driven by the company’s Pharmaceuticals and Consumer Health businesses. The figure, however, was marginally short of the Zacks Consensus Estimate of $ 13.5 billion.

All growth rates mentioned below are on a year-on-year basis and after adjusting for currency and portfolio changes.

Pharmaceuticals and Consumer Health Segments Drive Sales

Effective from the first quarter, Bayer is reporting results under five divisions – Pharmaceuticals, Consumer Health, Crop Science, Animal Health and Covestro.

Revenues at the Pharmaceuticals segment increased 8.4% backed by continued strong performance of the recently launched products including Xarelto, Eylea, Xofigo, Stivarga and Adempas. These products recorded combined sales of €1.3 billion, up 29%. Performance of the established product portfolio, which includes products like Aspirin Cardio, Glucobay, Gadavist/Gadovist, Kogenate/Kovaltry and Betaferon/Betaseron, was mixed in the second quarter of 2016. Overall, the company successfully expanded the Pharmaceuticals business in all regions.

Consumer Health segment sales were up 4% to €1.6 billion, driven by advances in all regions including Latin America/Africa/Middle East, Europe and Asia/Pacific regions except North America. Products like Claritin, Aspirin, and Bepanthen/Bepanthol and Canesten brands posted encouraging sales growth. However, Aleve and Dr. Scholl’s foot care products recorded a decline in sales.

Crop Science sales inched up 0.4% to €2.5 billion in the second quarter of 2016 in the face of an ongoing weak market environment. While seed growth, insecticides and herbicides posted double-digit percentage growth, fungicides declined considerably. The company has signed an agreement with SBM Développement SAS to divest its Consumer Business of the Environmental Science unit at Crop Science. The transaction is expected to close in Oct 2016.

Sales of the Animal Health business came in at €426 million, up 4.2%. The business benefited from increased demand in all regions.

Covestro posted sales of approximately €3 billion in the quarter, down 3.9% mainly due to lower selling prices. Selling prices declined mainly due to raw material price development and primarily at Polyurethanes business unit.

2016 Outlook Updated

Bayer updated the outlook for 2016. For 2016, the company expects sales of €46 billion to €47 billion (previously: more than €47 billion) including contribution from Covestro. This continues to represent an increase in the low-single-digit percentage range.

Bayer now projects core earnings, which include the company’s remaining stake in Covestro, to improve in the mid-to-high, single-digit percentage range (previously: a mid-single-digit percentage range).

The company continues to expect sales of approximately €35 billion at the Life Science businesses, which exclude contribution from Covestro. This still corresponds to an increase in the mid-single-digit percentage range as previously projected.

For Pharmaceuticals, Bayer now expects sales above €16 billion (previously: approximately €16 billion) despite some price declines. This now represents an increase in the high-single-digit percentage range (previously: mid-single-digit). Given the strong dynamics in the first half of the year, the company now expects sales of the recently launched pharmaceutical products to trend toward €5.5 billion (previously: to more than €5 billion). The company expects the biggest contributions from Xarelto and Eylea, with growth trending toward 30% for Xarelto and at least 30% for Eylea.

In the Consumer Health Division, Bayer now expects sales to come in at approximately €6 billion (previously: more than €6 billion). The company plans to grow sales by a low- to mid-single-digit (previously: mid-single-digit) percentage range.

Considering the challenging market environment, Bayer now expects Crop Science sales to remain at the prior-year level (previously: increase by a low-single-digit percentage). This is equivalent to reported sales of about €10 billion.

At Animal Health, Bayer continues to expect sales to be slightly above the prior-year level. For 2016, Covestro is now expecting a sales decline (previously: sales at the prior-year level).

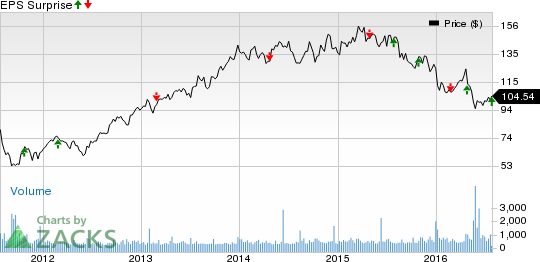

BAYER A G -ADR Price and EPS Surprise

BAYER A G -ADR Price and EPS Surprise | BAYER A G -ADR Quote

Our Take

Bayer’s second-quarter results were mixed, with the company topping bottom-line estimates but missing on revenues marginally. Nevertheless, the company’s Life Science businesses recorded encouraging sales growth, particularly the Pharmaceuticals and Consumer Health businesses. Moreover, newly launched products at the Pharmaceutical segment performed impressively during the quarter and should continue to do so in the upcoming quarters, evident from the raised 2016 outlook for the recently launched pharmaceutical products. Bayer also raised core earnings per share outlook for the year, which is encouraging.

Meanwhile, Bayer, which is looking to acquire Monsanto Company MON , raised its all-cash offer to the latter’s shareholders from $ 122 per share to $ 125 per share earlier this month. We note that through this acquisition Bayer is looking to create a global leader in agriculture. However, Monsanto rejected the revised offer citing that it was financially inadequate and insufficient to ensure deal certainty.

We note that Monsanto had rejected the initial offer of $ 122 per share in May 2016 on grounds that the offer significantly undervalued the company. However, the company is still open to more talks.

We expect investor focus to remain on updates from the Bayer-Monsanto transaction, going ahead.

Bayer currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the health care sector are Innoviva, Inc. INVA and ANI Pharmaceuticals, Inc. ANIP , each sporting a Zacks Rank #1 (Strong Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days . Click to get this free report >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BAYER A G -ADR (BAYRY): Free Stock Analysis Report

MONSANTO CO-NEW (MON): Free Stock Analysis Report

ANI PHARMACEUT (ANIP): Free Stock Analysis Report

INNOVIVA INC (INVA): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International