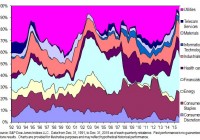

Stocks May Be a Slightly Better Bet in 2016 In my July 2, 2015 article on Seeking Alpha, I presented my then up-to-date Model Portfolio for Stock ETFs/funds. In this article, I will update my recommendations and include my latest Model Portfolio for Bonds along with my overall asset allocations. In spite of the perils of forecasting, I am raising my quarterly overall allocation to stocks, but just a tad. The main reason is merely because, although I don’t anticipate much better returns for stocks in 2016 than in 2015, using a 3 to 5 year horizon (my target range), stocks present a more favorable outlook than for bonds, and certainly, than for cash. The ongoing trend one-year trend for stocks, something I watch carefully, is now negative. While one year’s returns likely don’t show much of relationship to the following year’s performance, the high returns observed between 2009 and 2014 have led to a highly priced market. As a result, future returns are more likely, in my opinion, to be somewhat subdued. Here are my overall allocation recommendations, as subdivided into 3 rough categories based on one’s self-estimated tolerance for risk. For Moderate Risk Investors Asset Current (Last Qtr.) Stocks 52.5% (50%) Bonds 35 (35) Cash 12.5 (15) For Aggressive Risk Investors Asset Current (Last Qtr.) Stocks 67.5% (65%) Bonds 22.5 (22.5) Cash 10 (12.5) For Conservative Investors Asset Current (Last Qtr.) Stocks 20% (15%) Bonds 50 (50) Cash 30 (35) January 2016 Model Stock Fund Portfolio Value vs. Growth Categories Okay, fans of Large Growth funds, you’ve been consistently beating Large Value funds when looking at annualized past five year returns every January going all the back to Jan. 2010. That’s quite a string. This means if you over weighted the average Large Growth fund as early as Jan. 2005 and held that over weighted position throughout, your returns would have exceeded the average Large Value fund by about 2% each year, and the average of all U.S. diversified categories of funds by about 1% a year. What gives, and can the streak continue? Large Growth funds tend to contain heavy doses of Technology stocks as well as Consumer Cyclical stocks. Large Value funds are particularly attracted to Financial Services stocks, with more of a commitment toward Energy and Utility stocks. Both Technology and Consumer Cyclical have done quite well over the last 10 years, Utilities, Energy, and especially Financials, have not. As you probably are aware, Energy stocks have done particularly poorly over the last two years, while Financials took a particularly severe beating during the 2007-08 financial crisis and have been much slower to recover strongly since then compared to stocks as a whole. I have been overweighing Large Value over Large Growth for several years now which, up to now, hasn’t paid off. While both categories have done well, the average Large Growth fund has beaten the average Large Value fund by about 4% annually over the last 3 years. But, according to my proprietary research, while both categories should do adequately in the years ahead, Large Growth still comes out a little better on my list of most recommended US stock categories. The biggest question mark for value funds appears to be whether financial stocks, often their biggest component, can bounce off a relatively underperforming 2015, not to mention whether energy and utility stocks held in lesser amounts, can get back to anywhere near positive returns. In light of the continuing somewhat iffy prospects for Large Value funds, I am dropping my recommended allocation to 17.5% from 20%. Instead, I recommend putting the freed-up money into the Fidelity Contra Fund (MUTF: FCNTX ). I am also dropping my allocation to the Vanguard Financials ETF (NYSEARCA: VFH ) since our Large Value holdings already cover this sector. International Stock Funds Given the stronger prospects for most international funds as compared to U.S. stocks (described in my recent Jan. 2016 Seeking Alpha article “Best Stock ETF/Fund Categories For Future Gains”), I suggest a bumped up allocation to the former. U.S. stock funds, on average, have performed considerably better than international ones going back as far as 10 years. So, it might appear that I am running the risk of acting “prematurely” by going to an even higher international recommendation than before. This is always the chance one takes when one starts to favor underperforming categories under the assumption that they are “due” to turn things around. But my research suggests that more frequently than not, it is usually more important to recognize potential undervaluation in a category than to always wait for strong positive momentum trends before investing. Thus, while emerging market stocks currently have strong negative momentum, my research suggests that they offer among the best prospects for longer-term investors (along with some badly beaten up sector funds), but both mainly for Aggressive investors. It is interesting to note that stock markets in the Euro zone had a much better year in 2015 than US stock markets with a main index of European stocks up about 8%. However, for US investors, the increase in the value of the dollar vs. the Euro resulted in much of those gains being wiped away, unless you were invested in a European fund that hedges its currency exposure, such as the WisdomTree Europe Hedged Equity ETF ( HEDJ) mentioned below. Our Specific Fund and Allocation Recommendations Now (vs Last Qtr.) Fund Category Recommended Category Weighting Now (vs Last Qtr.) Fidelity Low Priced Stock Fund (MUTF: FLPSX ) 10% (12.5%) Mid-Cap/ Small Cap 10% (12.5%) Fidelity Overseas Fund (MUTF: FOSFX ) 5 (0) (New!) Vanguard Europe Index Fund (MUTF: VEURX ) 5 (10) Vanguard Pacific Index Fund (MUTF: VPACX ) 10 (10) Tweedy, Browne Global Value Fund (MUTF: TBGVX ) 5 (5) Vanguard Emerging Markets Stock Index Fund (MUTF: VEIEX ) 10 (7.5) DFA International Small Cap Value Portfolio (MUTF: DISVX ) 5 (2.5) (See Notes 1, 2 and 3.) International 40 (35) Fidelity Large Cap Stock Fund (MUTF: FLCSX ) 7.5 (7.5) Vanguard 500 Index Fund (MUTF: VFINX ) 7.5 (7.5) Large Blend 15 (15) Vanguard Growth Index Fund (MUTF: VIGRX ) 7.5 (7.5) Fidelity Contra 7.5 (5) Large Growth 15 (12.5) T. Rowe Price Value Fund (MUTF: TRVLX ) 5 (7.5) Vanguard Equity Income Fund (MUTF: VEIPX ) 7.5 (0) (New!) Vanguard U.S. Value Fund (MUTF: VUVLX ) 5 (5) Large Value 17.5 (20) Vanguard Energy Fund (MUTF: VGENX ) 2.5 (2.5) Sector 2.5 (5) Notes: ETFs (exchange traded funds) of the same category can be substituted for any of the above Vanguard index funds; e.g. the Vanguard FTSE Europe ETF (NYSEARCA: VGK ) can be substituted for VEURX. Although not included in the Model Portfolio, you may want to consider two other (or additional) international ETFs: the WisdomTree Europe Hedged Equity ETF (NYSEARCA: HEDJ ) and the WisdomTree Japan Hedged Equity ETF (NYSEARCA: DXJ ). These ETFs, unlike the Vanguard Europe and Pacific funds, tend to do better when the US dollar is strong, as it has been since roughly mid-2011. January 2016 Model Bond Fund Portfolio Comments on Our Updated Bond Recommendations Our bond fund recommendations remain highly similar to last quarter’s recommendations. (Note: If you wish to see the Oct. 2015 recommendations, you can go to this link .) We are increasing our allocation to the Vanguard Intermediate-Term Tax-Exempt Fund as muni bonds seem to be one of the best options for both safe and decent after-tax yields. Since gradually rising interest rates could potentially hurt bond fund prices, we are sticking with short and intermediate term maturity funds. (Long-term bond funds have generally done a little worse in 2015 than short and intermediate term funds.) We are dropping Metropolitan West Total Return Bond Fund, included in the last Portfolio, because its performance has not exceeded that of the major bond benchmark, the Barclays US Aggregate Bond Index (AGG). Our Specific Fund and Allocation Recommendations Now (vs Last Qtr.) Fund Category Recommended Category Weighting Now (vs Last Qtr.) PIMCO Total Return Fund (MUTF: PTTRX ) 25% (25%) Harbor Bond Fund (MUTF: HABDX ) 0 (0) (See Note 1.) PIMCO Total Return ETF (NYSEARCA: BOND ) 5 (5) Diversified 30% (35%) DoubleLine Total Return Bond Fund (MUTF: DBLTX ) 7.5 (7.5), or DoubleLine Total Return Bond Fund (MUTF: DLTNX ) (See Note 2.) Interm. Term 7.5 (7.5) Vanguard Intermediate-Term Tax-Exempt Fund (MUTF: VWITX ) 17.5 (15) Interm. Term Muni 17.5 (15) Vanguard Short Term Investment Grade Fund (MUTF: VFSTX ) 10 (7.5) Short-Term Corp. 10 (7.5) Vanguard High Yield Corporate Fund (MUTF: VWEHX ) 10 (10) High Yield 10 (10) PIMCO Foreign Bond Fund (U.S. Dollar-Hedged) (MUTF: PFRAX ) 25 (25) International 25 (25) Notes: When possible, select PTTRX; HABDX is only recommended if you cannot met PTTRX’s minimum. The two funds are the same but have different minimums; select DBLTX if possible because of lower expense ratio.