A Case For Active Investment Management

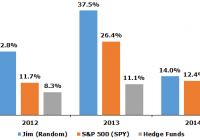

Summary Investing in fundamentally strong companies. Active Management vs. Benchmarking. Potential for reduced exposure to declining markets. “The most successful investment managers generally possess three qualities: independent thought, discipline, and consistency of application” – John Train in his book The Money Masters. “It is impossible to produce superior performance unless you do something different from the majority.” – Sir John Templeton. Screening for Fundamentally Strong Companies For over 15 years I have been a multi-asset class investor, advisor and analyst. My teams over the years have managed a variety of active strategies. While different in focus, every equity based strategy incorporates fundamental investment principles. Regardless of the fad of the day or the hot company everyone is talking about, consistent performance and risk management depends on these principles. I have recently collaborated with a group of CFA charterholders to form an all-cap equity strategy from our most successful strategies with the sole purpose of generating exceptional risk adjusted returns. Below is a summary of the parameters we use. All Alpha Strategy Parameters Price to Book < 1.5 7 years of positive operating margin 3 years roe > 15% Lowest 20% of growth adjusted free cash flow multiple Companies with above average operating and net margin within their respective industry Below average debt to equity Positive cash flow ROA growing D/E declining Current ratio, gross margin, asset turnover growing Cash flow > net income Consistent earnings growth Momentum parameters Thanks to Henry Crutcher and Equities Lab for creating a great quantitative tool that enables us to generate and successfully back test the performance of our fundamental and technical based strategies for the periods we don’t have actual trading history. See the output since 1997 from the program below. Here is a list of every trade for the past 15 years. Recently passing companies: (click to enlarge) The results from the model were strong. Upon verifying the data, 13.12% annualized is accurate. I then combined it with a proprietary risk management model that helps us anticipate significant market declines and the results were even more encouraging. I nvesting in fundamentally strong companies Investing “is pursued most successfully in a simple, straightforward way.” – Brad Perry, Winning the Investment Marathon. Buy stocks of high-quality companies at good prices and continue holding them as long as the companies’ performance merits doing so. Do this consistently and the probability an investor will enjoy above average returns substantially increases. Below are brief descriptions of the investment parameters. 1. Price to Book < 1.5 As a primary measure of value, the price to book ratio is an initial screen that seeks to pass securities that have moved away from their true value due to neglect and are typically out of favor. These securities over time have proven to be successful investments. 2. 7 years of positive operating margin Consistent operating margins are a positive sign a company's underlying business is successful and seemingly sustainable. 3. 3 years roe > 15% Strong and consistent return on equity is essential. 4. Lowest 20% of growth adjusted free cash flow multiple Using price/free cash flow multiplied by 5 year growth of free cash flow is a valuation measure. 5. Companies with above average operating and net margin within their respective industry This measure helps us choose the leaders in each investment’s respective industry. 6. Below average debt to equity Because overleveraged companies are not attractive. 7. ROA growing We prefer the companies we invest in to get better at what they do over time. Additionally, we look for companies that invest internally and that return produces consistently growing ROA. Otherwise, our money is better invested elsewhere. This is a year over year measure. 8. D/E declining Efficient use of debt is important, as well as consistent retirement of debt. 9. Current ratio, gross margin, asset turnover growing Measures of liquidity, profitability and business activity. 10. Cash flow from Operations > net income This is a simple accrual accounting check to avoid companies that may be attempting to manage earnings. 11. Consistent earnings growth Earnings growth attracts attention. We again use year over year measures that help us identify companies that are poised to move. 12. Momentum parameters in the form of relative strength play an important role in our growth oriented screen. It helps identify companies with attractive price movement but remain appropriately valued. In addition, we tend to focus our attention to price movers that are within 15% of recent highs. Active Management vs. Benchmarking So I guess you now have me pegged as an active investor. I personally don’t consider myself active or passive, I consider myself a fundamentally based technical investor, meaning I buy when it makes sense and sell when things start looking uncertain. My current domestic exposure, managed with a beta weighted futures overlay on a long portfolio, is 100% hedged due to current volatile economic conditions. The exposure metric was derived by analyzing market valuations and economic indicators. It is updated monthly, which may also be considered an actively managed strategy. Regardless of my bias, active management has taken a beating over the past few years and rightfully so, in many instances, such as the “active” managers that are more concerned about underperforming than actually providing value to their clients. In other cases, active management can provide an investor peace of mind and tremendous value if the strategy is fundamentally sound and is implemented consistently. William Sharpe stated in the Arithmetic of Active Management (The Financial Analysts’ Journal Vol. 47, No. 1, January/February 1991. pp. 7-9): If “active” and “passive” management styles are defined in sensible ways, i t must be the case that 1. before costs, the return on the average actively managed dollar will equal the return on the average passively managed dollar and 2. after costs, the return on the average actively managed dollar will be less than the return on the average passively managed dollar The problem with this statement from William Sharpe is that it assumes the active manager seeks to benchmark a specific market such as large cap, small cap, etc. As a business, active managers live and die on performance against their respective benchmarks. Knowing this, many use enhanced benchmarking. Enhanced benchmarking involves an active manager investing in an essentially passive portfolio of securities that mimic a benchmark. However in addition to this passive allocation, these active managers will use derivatives or some other portable alpha to “enhance” portfolio performance in an attempt to reduce the risk of underperforming the benchmark and providing the possibility of outperforming at any random time. Additionally, active managers may also stray from their benchmark allocations by adding smaller cap and potentially higher returning securities. This is known as style drift and measured by tracking error. Oftentimes, these additional measures do not add sufficient alpha to offset higher risk and fees. These are reasons a high percentage of active managers perform poorly after fees compared to passive index investing. Potential for reduced exposure to declining markets As seen in the Business Cycle Overlay data, the potential for reduced exposure to declining markets can be substantial if executed properly. The model effectively reduces equity risk when valuations become rich and economic conditions warrant more caution. Returns from effectively managing downturns is termed the buy-and-hold equalizer. The buy-and-hold equalizer (Why Market Timing Works, Journal of Portfolio Management, Summer 1997), represents the increased leverage an active investment strategy gains by preserving capital during a market drop. The more money an investor has to invest when the market turns up, the greater the performance leverage. The following passage is from NAAIM . When properly implemented, active management strategies should lessen an investor’s exposure to declining markets, blunting the impact of bear markets and preserving capital and the majority of prior gains. Moving out of the market prior to the majority of a decline means you have more money to invest when the market heads upward. Active investment management is most effective over a full market cycle (3 to 5 years). The reality of down markets provides the rational for active management. Down markets hurt investors in a number of ways. First, the more investors lose money in a down market, the more they lose valuable time and opportunity. Over the past 70 years, the major indices spent nearly 60% of the time sitting out bear markets and then returning to earlier highs. Only about 40% of the time were real gains being made. Through the use of active management strategies, money managers seek investment approaches that moderate the volatility of the market, helping investors stay the course and benefit from the long-term gains of the market and improve risk adjusted returns. Additionally, active management offers potential benefits beyond performance. Unlike with passive approaches, active managers are not required to invest cash inflows at the time of receipt when market conditions or prices may not be conducive. They can screen for quality and use buy/ sell triggers as a means of reducing risk. While a passive manager must own everything in an index, an active managers have the freedom to look for attractive stocks across the targeted universe. Summary Active management is an effective tool if used properly. It can not only lead to larger gains, but also reduce risk. However, it is very important for investors to understand the underlying investment strategy of a particular investment regardless of whether it is active or passive. Moreover, an investor should compare the statistics of an active strategy (Total Return, Standard Deviation, Calmar Ratio, Sharpe Ratio, Information Ratio, and Tracking Error) to that of a similar passive to determine if the higher fees are producing sufficient additional gains to warrant an investment. I will follow up this article with regular investment and economic analysis specific to these strategies, highlighting passing companies and providing economic rationale for managing an investment portfolio. Follow me to stay informed.