Maximizing Shareholder Value: A Dumb Idea?

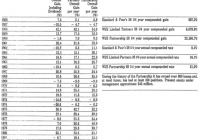

Sometime in 2007, I called the Investor Relations head of a leading Indian power company. “I request for a meeting with your CFO,” I said. “Where are you calling from?” she asked back. “I work for an independent research company working for retail investors, and we are looking to initiate coverage on your stock,” I replied. “I had some questions before writing the report, and thus wanted to meet your CFO.” “Are you writing a Buy or a Sell report on our stock?” she asked. “How can I tell you that now?” I said. “I need to finish my research, and only then will I make a judgement on whether the stock is a Buy or a Sell.” “Wait, you are from a retail research organization, right?” she asked. “Sorry, we do not have a policy to meet companies focused on retail investors. We only meet the institutional guys because they can help up increase our market cap, not the retail guys. We want to maximize shareholders’ wealth, you see.” I loved her honesty, but was shocked to hear such a response from a public company, which had a policy of maximizing shareholder wealth, and fast, and by excluding a large set of its shareholders. What a Dumb Idea! Peter Drucker said in 1973: The only valid purpose of a firm is to create a customer. Drucker’s perspective was that the goal of a firm isn’t fundamentally about creating profits or maximizing shareholder value. Profits and shareholder value are the results of adding value to customers, not the goal. Even the legendary Jack Welch has come to see that maximizing shareholder value is “the dumbest idea in the world.” “On the face of it, shareholder value is the dumbest idea in the world,” Welch said, “Shareholder value is a result, not a strategy…your main constituencies are your employees, your customers and your products.” Seth Godin wrote in a recent post – The purpose of a company is to serve its customers. Its obligation is to not harm everyone else. And its opportunity is to enrich the lives of its employees. Somewhere along the way, people got the idea that maximizing investor return was the point. It shouldn’t be. That’s not what democracies ought to seek in chartering corporations to participate in our society. The great corporations of a generation ago, the ones that built key elements of our culture, were run by individuals who had more on their mind than driving the value of their options up. Contrast this with what most companies and their managers do, i.e., focus on short-term profits and stock price maximization, because this is an easy thing to do. Look at what the DCB Bank did recently. Some days back, the management announced that the bank’s profits would take a knock as it tries to double its branch network in the next one year. On this news, the stock price crashed 30% in quick time. Shattered by this crash in the stock, the management revised its plan saying that, “after consultations with analysts and its chairman,” it would now not rush with the opening of new branches. Instead of setting up 150 branches over the next one year, it will do this over two years. While I have no view on the bank or how this branch expansion would have helped or hurt it, the questions that arise are: How can a management change its corporate plan while keeping an eye on the stock price? How on earth can you consult stock market analysts on what you want to do as corporate managers? The answer, again, seems to be – focus on short-term profit and stock price maximization versus long-term goals. All CEOs and corporate managers appearing on business channels talking about their profits and next quarter’s or year’s performance are focused on just that – maximizing their company’s stock prices in the short term. Companies that never organize analyst meets or conference calls and become active when their stock price is rising are also focused on that – further maximizing their stock prices in the short term. Companies that pay dividends out of borrowed money are also doing the same. Steve Denning wrote this in his 2011 article on Forbes: CEOs and their top managers have massive incentives to focus most of their attentions on the expectations market, rather than the real job of running the company producing real products and services. The real market is the world in which factories are built, products are designed and produced, real products and services are bought and sold, revenues are earned, expenses are paid, and real dollars of profit show up on the bottom line. That is the world that executives control-at least to some extent. The expectations market is the world in which shares in companies are traded between investors-in other words, the stock market. In this market, investors assess the real market activities of a company today and, on the basis of that assessment, form expectations as to how the company is likely to perform in the future. The consensus view of all investors and potential investors as to expectations of future performance shapes the stock price of the company. Roger Martin wrote this in his book ” Fixing the Game “: What would lead [a CEO] to do the hard, long-term work of substantially improving real-market performance when she can choose to work on simply raising expectations instead? Even if she has a performance bonus tied to real-market metrics, the size of that bonus now typically pales in comparison with the size of her stock-based incentives. Expectations are where the money is. And of course, improving real-market performance is the hardest and slowest way to increase expectations from the existing level. Invest with People Focused on Customers, Not Stock Prices The problem with short-term stock price maximization is that it’s not particularly difficult. If a company has a big market share, or if it’s difficult for the customer to switch away from the company’s product, or if the customer lacks the knowledge of better options, it’s easy for the company to hurt its customers on the way to boosting what the shareholders say they want. So, it’s not difficult for Nestle ( OTCPK:NSRGY , OTCPK:NSRGF ) to be casual about what its super-branded food products contain (thanks to its large market share), or for Indian Railways to provide sub-standard travel experience (customers don’t easily switch), or for financial services companies to mis-sell bad products (customers lack knowledge about good products). But just because it works doesn’t mean that they should be doing it to maximize short-term profits, and in many cases, their stock prices. Contrast this with what Jeff Bezos and Larry Page are doing at Amazon (NASDAQ: AMZN ) and Alphabet ( GOOG , GOOGL ) respectively – focusing only, and only, on the customer. The reason they have created so much wealth for their shareholders is because they never cared about shareholder value maximization, but only about customer satisfaction. Consider the Purpose Statement of Procter & Gamble (NYSE: PG ) (emphasis mine) : We will provide branded products and services of superior quality and value that improve the lives of the world’s consumers, now and for generations to come. As a result , consumers will reward us with leadership sales, profit and value creation, allowing our people, our shareholders and the communities in which we live and work to prosper. For P&G, consumers come first and shareholder value naturally follows. As per the statement of purpose, if P&G gets things right for consumers, shareholders will be rewarded as a result. This, I am sure, has also been the mantra of India’s biggest long-term wealth creators like HDFC (NYSE: HDB ), Asian Paints ( OTC:ASNQY ), Sun Pharma ( OTC:SMPQY ), Infosys (NYSE: INFY ), and Wipro (NYSE: WIT ). They have created tremendous shareholder wealth as a result of their focus on their customers and building their business for the long term, and not the other way round. This is how you can also find a few of the future wealth creators – businesses where managements are not focused on shareholder wealth creation, but treat it just as a byproduct of delighting its customers, employees, and the society at large. Such are the businesses where you will find long-term sustainable moats. Every other moat – especially if it appears a lot on business television, is worshipped by everyone around, and where the management often touts its shareholder-friendliness – is often fleeting. “Mr. Market suffers from incurable emotional problems,” Ben Graham wrote while describing the daily madness of stock price movements. Why would you want to partner with business managers who focus on managing these incurable problems of Mr. Market, rather than minding their business?