Tetraphase Pharma Offers A Lesson In Risk Management

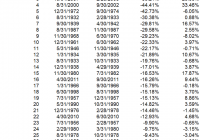

Summary Limit sell orders wouldn’t have protected investors from Tetraphase Pharmaceutical’s 78% plunge after hours Tuesday. Two ways for investors to limit downside risk from stock plunges like this are diversification and hedging. We examine the pros and cons of both of those methods of risk management. Tetraphase Tanks After Hours Shares of Tetraphase Pharmaceuticals (NASDAQ: TTPH ) closed up 3.54% on Tuesday, to $44.78. Less than 40 minutes later, TTPH was trading for under $10 per share after hours, as the dramatic graph below from YCharts shows. (click to enlarge) What tanked the stock, as Seeking Alpha news editor Douglas House reported , was the failure of its leading drug candidate, a broad spectrum antibiotic called Eravacycline , in a stage 3 clinical trial versus another antibiotic called Levofloxacin in the treatment of complicated urinary tract infections. Limit Sell Orders Don’t Limit The Loss A painful lesson some Tetraphase longs may learn here is that limit sell orders don’t protect against these kinds of drops. Consider, for example, a hypothetical investor who owned Tetraphase on Tuesday and didn’t want to see his position value drop by more than 20%, so he set a limit sell order at $36. The problem with this sort of limit sell order is that it won’t get you out of the stock at $36 per share, if the stock never trades at that price on its way down. Whatever price the stock opens at the next day is the price an investor would be offered for selling the stock then. Two Ways To Limit Stock-Specific Risk Two ways to limit stock-specific risk of this kind are diversification and hedging. Both have their advantages and disadvantages. The big advantage of diversification is that it doesn’t cost much.[i] As the Nobel laureate economist Harry Markowitz famously put it, “diversification is the only free lunch”. If you owned Tetraphase as part of an equal-weighted portfolio of 20 stocks on Tuesday, the worst impact it could have on your portfolio value going forward would have been -5%, because it would have comprised 5% of your portfolio. Of course, the flip side to diversification is that if a particular stock does very well, its impact to your portfolio would be similarly limited. Diversification limits the harm caused by your worst investment, but it also limits the benefit provided by your best ones. As Warren Buffett noted in a lecture at the University of Florida’s business school in 1998, If you can identify six wonderful businesses, that is all the diversification you need. And you will make a lot of money. And I can guarantee that going into the seventh one instead of putting more money into your first one is going to be terrible mistake. Very few people have gotten rich on their seventh best idea. But a lot of people have gotten rich with their best idea. Unlike diversification, hedging allows you to concentrate your assets in a handful of securities you think will do best, because your downside is strictly limited. Consider, for example, hedging with put options. Put options (or, puts) are contracts which give you the right to sell a security for a specified price (the strike price) before a specified date (the expiration date). An investor who owned 1,000 shares of Tetraphase on Tuesday and 10 put option contracts (each contract covers 100 shares) with strike prices at $40, would have been able to sell all of his Tetraphase shares for $40 on Wednesday, regardless of what price the stock was trading at then. The main drawback with hedging, though, is its cost. At Portfolio Armor , we look for optimal puts (as well as optimal collars) when hedging. Optimal puts are the ones that will give you the level of protection you are looking for at the lowest cost. A Tetraphase investor scanning for optimal puts on Tuesday against a greater-than-20% drop over the next several months, would have gotten this message, The reason he would have seen that message is that the cost of protecting against a greater-than-20% drop on Tuesday was itself greater than 20% of position value. The smallest decline threshold against which it was possible to hedge TTPH over the same time frame with optimal puts on Tuesday was against a greater-than-27% drop, and, as the image below shows, the cost of doing so was prohibitively expensive – equivalent to nearly 27% of position value. Note that, in the image above, the “cap” field is blank. If an investor had entered a figure in that field, the app would have attempted to find an optimal collar to hedge Tetraphase. A collar is a type of hedge in which an investor buys a put option for protection, and, at the same time, sells a call option, which gives another investor the right to buy the security from him at a higher strike price, by the same expiration date. The proceeds from selling the call option can offset at least part of the cost of buying the put option. An optimal collar is a collar that will give you the level of protection you want at the lowest price, while not capping your possible upside by more than you specify. In a nutshell, with a collar you may be able to reduce the cost of hedging, in return for giving up some possible upside. It was possible to hedge Tetraphase against a greater-than-20% drop over the next several months with an optimal collar on Tuesday, if an investor were willing to cap his possible upside over the same time frame at 20%. The cost of that protection would have been 8.26% of position value, which would still have been fairly pricey. Using Security Selection To Reduce Risk (and Hedging Costs) Another way to reduce risk, and to hedging costs, is to avoid stocks like Tetraphase in the first place. That may sound like hindsight at this point, but remember the hedging cost shown above was calculated using data from before the stock tanked. Hedging cost that high can be a red flag. By way of comparison, look what the cost of hedging Gilead Sciences (NASDAQ: GILD ) against the same percentage drop over the same time period with optimal puts was on Tuesday: As you can see at the bottom of the image above, Gilead cost 2.1% of position value to hedge. Tetraphase was 12.6x as expensive to hedge in the same manner. By limiting your portfolio to securities that are relatively inexpensive to hedge, you will end up avoiding some of the riskiest ones. How much should you be willing to spend to hedge? That depends, in part, on how high you estimate the potential return of your underlying securities. One approach is to calculate both hedging costs and potential returns for your best ideas, then, subtract the hedging costs from the potential returns, rank them by potential return net of hedging cost, and buy and hedge a handful of the highest ranked ones. That’s the essence of the hedged portfolio method, which we detailed in a recent article (“Keeping A Small Nest Egg From Cracking”). —————————————————————————– [i] To be precise, this isn’t quite true if you buy individual stocks rather than a low-cost index fund. All else equal, the more you diversify, the more trading costs you will incur. Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.