Stocks Look Expensive… And Still Attractive

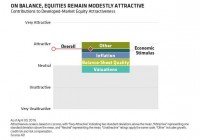

By Ilya Figelman Developed-market equity valuations seem a bit expensive today – but we still think they’re worth an overweight in multi-asset strategies. A wider view shows that stocks remain attractive globally. Let’s start with valuations. To get a comprehensive assessment, we integrate traditional measures such as the price/earnings ratio with other key corporate metrics. These include sales, cash flows and dividends; sales, for example, are currently on the low side relative to earnings. Based on our more robust valuation measure, global developed-market equities are unattractive. US Federal Reserve Chair Janet Yellen, commenting recently on the US equity market, echoed that assessment: “Equity market valuations at this point generally are quite high.” Good Quality Mostly Offsets High Valuations But valuations are only part of the equation when we’re gauging the intrinsic value of stocks. Investors need to incorporate aspects of quality, too. And globally, corporations are pretty healthy. Net equity issuance is low by historical standards. This means there’s a high volume of stock buybacks, which increase shareholder value, compared with new stock issuance, which dilutes value. When we roll all of this together, the positive impact of strong quality offsets almost all the negative impact of poor valuations. But even that still leaves the assessment for developed-market equities in roughly neutral ground. What’s missing? Macro Factors Argue in Favor of Equities The answer is the impact of the macro environment on equity attractiveness. It’s not enough to simply look at the intrinsic aspects of valuations and quality. We need to incorporate how macro aspects stack up for or against equities. And in short, unattractive valuations are mostly offset by strong quality, with the macro impact of falling inflation pressures and strong economic stimulus tilting the balance in favor of an equity overweight (Display) . What’s the best way to capture the effect economic conditions such as inflation and stimulus have on the equity decision? We think you need to come at the question from both quantitative and fundamental angles. We prefer to start with market-based metrics instead of economic releases; they’re timelier and, in our experience, more accurate in predicting equity market returns. Oil Rebounds, But is Still Well Below its Peak To determine the impact of inflation, we mainly look at changes in commodity prices and breakeven inflation rates. Inflation pressures have been declining largely because of falling commodity prices since mid-2014, and they’re a strong positive factor making equities attractive. Even though per-barrel oil prices have rebounded somewhat from the upper $40s to near $60, they’re still well below last summer’s near-$100 high. This quantitative signal is supported by AB’s fundamental research, which asserts that lower oil prices have been driven predominantly by supply rather than demand. This dynamic should generally be a positive for equity prices. Also, our economic research views the decline in energy prices as a boost for consumers, and therefore, good for equities. Recent Uptick in Bond Yields, but Plenty of Stimulus Remains What about economic stimulus? To gauge that impact, we use the level of – and changes in – government bond yields. Despite the US Federal Reserve tapering and contemplating official rate increases this year, officials are still likely to withdraw stimulus very cautiously – and slower than economic conditions warrant. Other central banks are providing more stimulus: the European Central Bank and Bank of Japan are at the beginning of easing cycles. From the market’s perspective, the pronounced global stimulus is reflected in low and declining bond yields, and that’s very favorable for equities. We’ve seen rates turn upward recently – 10-year German bund yields, for instance, rose from about 8 basis points in mid-April to about half a percent today. But rates still remain relatively low. We were more favorable on equities before oil prices and interest rates rose recently, and the equity markets have indeed performed well. We’ll be watching these two macro factors carefully, along with other variables that impact overall equity assessment. There’s a lot more to investing in equities beyond the high-level decision of how much to allocate to the asset class. Investors need to make regional, country, sector and security decisions, too. But the asset allocation decision is vital, and we still think the current balance of valuations, quality measures and the macro environment favors an overweighting to equities versus strategic portfolio allocations. Ilya Figelman is Portfolio Manager – Dynamic Asset Allocation at AB (NYSE: AB ).