Scalper1 News

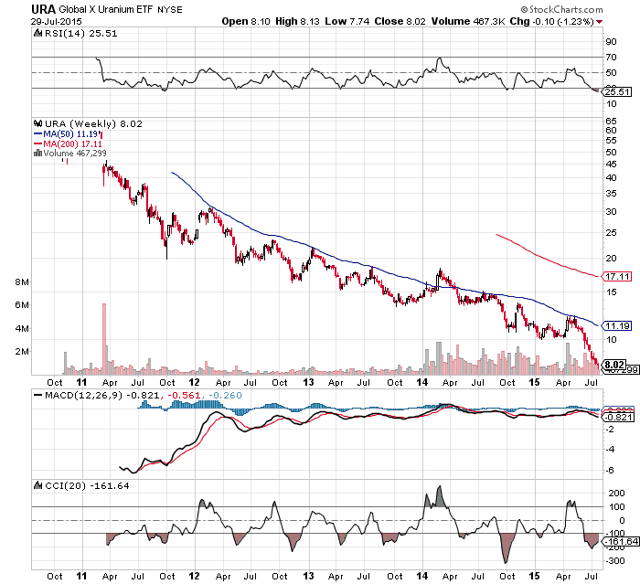

Summary Global demand for uranium is set to grow for the long term, which will cause an inevitable rise in prices. Japan is set to restart its nuclear industry with its first reactor ready to restart in August. Asian demand for energy, driven by China, S. Korea and India will demand significantly more uranium than is presently available. This is the first article of two wherein I will lay out the case that uranium prices are set to soar in the near future, perhaps as soon as the end of this year and/or into 2016. I will also provide a suggestion on an easy way to invest in the uranium sector with the potential to reap significant return on your invested capital. In my next article, I will provide investors interested in this sector with information on a number individual companies involved in the mining/production of uranium. These suggestions can be a source basis for your own further research/due diligence with the goal of providing your portfolios with a significant boost in value. The Market for Uranium According to the World Nuclear Association, the world’s nuclear power reactors currently require about 68,000 tonnes of uranium each year. The supply is provided from both mines and other sources, such as nuclear weapons stockpiles and civil stockpiles held by utilities and governments. ( source ) In 2014, the world’s total production of uranium from mining activity was 56,217 tonnes, a shortfall of 12,000 tonnes of the current requirement for world reactors. Through 2013, highly-enriched uranium from weapons stockpiles had displaced approximately 8850 tonnes of U3O8 production from mines each year, meeting about 13 to 19 percent of world reactor requirements. ( source ) Individuals who follow the uranium market are aware of the Megatons to Megawatts deal that was signed in 1993 between the USA and Russia. It was an agreement whereby the USA, “over a 20-year period, would purchase 500 tonnes of Russian ‘surplus’ high-enriched uranium (HEU) from nuclear disarmament and military stockpiles. These were to be bought by the USA for use as fuel in civil nuclear reactors. In return, the USA transferred to Russia a similar quantity of natural uranium to replace that used to downblend the HEU.” (source) This deal concluded at the end of 2013. At present, there are 437 operating nuclear power plants worldwide, and there are 60+ new plants under construction in 13 countries plus Taiwan. China has 26 operating reactors and 24 under construction . India has 21 operating reactors and 6 under construction . The USA has 5 reactors under construction and has plans to build 5 more new reactors . South Korea is planning to bring 4 reactors online by 2018 and another 8 by 2030. (for more information, see here ). Nuclear power capacity is steadily increasing on a global basis. Plant upgrading is resulting in significant capacity increases . e.g., Switzerland’s 5 plants have had their capacity increased by 13.4%, Spain’s 9 reactors have had capacity increased by 13% and numerous other countries have had capacity increased through upgrading or are in the process of doing so. Plant life extension programs are maintaining current capacity, especially in the U.S. Currently, Japan has all of its nuclear reactors shut down. As many of you reading this know, this was the result of the 2011 Fukushima accident caused by the tsunami that hit Japan March 11, 2011. However, on July 10, 2015, Kyushu Electric Power Co. announced that its Sendai Nuclear Power Unit No. 1 had completed fuel loading in preparation for its restart in August. It’s 2nd unit may be restarted as soon as September. Japan is slowly moving towards getting its nuclear industry going again. As of the end of the financial year to March 31, 2015, Japan had imported a record 7.78 trillion ($65 billion) of natural gas in order to make up for the shortfall in energy that was previously generated by the nuclear industry. Importing that much LNG has had a negative impact on Japan’s economy, making it significantly more expensive for industry to operate and squeezing profits. It has also caused an increase in household utility bills. The importing of so much LNG has also caused Japan to begin posting trade deficits, something unheard of prior to the shutting down of all of the nuclear reactors. Presently there are 25 reactors in Japan that are seeking a restart and the government, led by Prime Minister Shinzo Abe, wants to start as many as possible “to meet the nation’s energy needs and grow the economy.” ( source ) The restarting of Japan’s nuclear reactors should have a positive impact on the price of uranium. The psychological barrier to investing in the sector that shutting down its reactors caused will be removed and this should be bullish for the price. The restarts will also boost the confidence of investors in the industry as a whole and the long-term prospects for the nuclear power industry. Although Germany is planning to decommission all of its nuclear power plants by 2020, there is a real fear by taxpayers in the country that they will have to foot the bill for the increase in prices that are going to be an inevitable cost of shuttering the nuclear power industry. So, will Germany reverse course and eventually go back to using nuclear energy or power generation? Time will tell, but even the country does get completely out of nuclear power generation, it really won’t have any negative impact on the inevitable rise in prices ahead. This is because of the Asian move towards nuclear energy to meet the massive need for power in that area of the world, home to 4.47 billion people. In East through to South Asia, there are currently 123 operating nuclear power reactors, 41 under construction and firm plans to build 92 more, while many more are proposed. The greatest growth in nuclear power generation is expected in China, South Korea and India. ( source ) How To Invest In The Sector Aside from investing in individual uranium mining and processing companies, some of which I will highlight in my next article on this subject, one way to invest in this sector is through the Global X Uranium ETF (NYSEARCA: URA ). See the chart below. (click to enlarge) URA tracks the Solactive Global Uranium Index and both the index and the ETF include companies involved in the exploration, mining, and harnessing of uranium. Some of the top holdings include Cameco Corp. (NYSE: CCJ ), Uranium One (TSE-UUU), and Hathor Exploration (TSX-HAT). You can see from the chart above that the ETF has seen its price decimated by the melt down (pun intended) in the sector since 2011 and the fall in the price of uranium, which currently sits at a spot price of Nevertheless, for contrarions, this presents a great time to consider investing some funds in this space, especially as the uranium price, currently sitting at approximately $36/pound, is bound to begin rising in response to the inevitable demand/supply imbalance created by the need for more and more affordable and clean energy sources, especially in Asia. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in URA over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Summary Global demand for uranium is set to grow for the long term, which will cause an inevitable rise in prices. Japan is set to restart its nuclear industry with its first reactor ready to restart in August. Asian demand for energy, driven by China, S. Korea and India will demand significantly more uranium than is presently available. This is the first article of two wherein I will lay out the case that uranium prices are set to soar in the near future, perhaps as soon as the end of this year and/or into 2016. I will also provide a suggestion on an easy way to invest in the uranium sector with the potential to reap significant return on your invested capital. In my next article, I will provide investors interested in this sector with information on a number individual companies involved in the mining/production of uranium. These suggestions can be a source basis for your own further research/due diligence with the goal of providing your portfolios with a significant boost in value. The Market for Uranium According to the World Nuclear Association, the world’s nuclear power reactors currently require about 68,000 tonnes of uranium each year. The supply is provided from both mines and other sources, such as nuclear weapons stockpiles and civil stockpiles held by utilities and governments. ( source ) In 2014, the world’s total production of uranium from mining activity was 56,217 tonnes, a shortfall of 12,000 tonnes of the current requirement for world reactors. Through 2013, highly-enriched uranium from weapons stockpiles had displaced approximately 8850 tonnes of U3O8 production from mines each year, meeting about 13 to 19 percent of world reactor requirements. ( source ) Individuals who follow the uranium market are aware of the Megatons to Megawatts deal that was signed in 1993 between the USA and Russia. It was an agreement whereby the USA, “over a 20-year period, would purchase 500 tonnes of Russian ‘surplus’ high-enriched uranium (HEU) from nuclear disarmament and military stockpiles. These were to be bought by the USA for use as fuel in civil nuclear reactors. In return, the USA transferred to Russia a similar quantity of natural uranium to replace that used to downblend the HEU.” (source) This deal concluded at the end of 2013. At present, there are 437 operating nuclear power plants worldwide, and there are 60+ new plants under construction in 13 countries plus Taiwan. China has 26 operating reactors and 24 under construction . India has 21 operating reactors and 6 under construction . The USA has 5 reactors under construction and has plans to build 5 more new reactors . South Korea is planning to bring 4 reactors online by 2018 and another 8 by 2030. (for more information, see here ). Nuclear power capacity is steadily increasing on a global basis. Plant upgrading is resulting in significant capacity increases . e.g., Switzerland’s 5 plants have had their capacity increased by 13.4%, Spain’s 9 reactors have had capacity increased by 13% and numerous other countries have had capacity increased through upgrading or are in the process of doing so. Plant life extension programs are maintaining current capacity, especially in the U.S. Currently, Japan has all of its nuclear reactors shut down. As many of you reading this know, this was the result of the 2011 Fukushima accident caused by the tsunami that hit Japan March 11, 2011. However, on July 10, 2015, Kyushu Electric Power Co. announced that its Sendai Nuclear Power Unit No. 1 had completed fuel loading in preparation for its restart in August. It’s 2nd unit may be restarted as soon as September. Japan is slowly moving towards getting its nuclear industry going again. As of the end of the financial year to March 31, 2015, Japan had imported a record 7.78 trillion ($65 billion) of natural gas in order to make up for the shortfall in energy that was previously generated by the nuclear industry. Importing that much LNG has had a negative impact on Japan’s economy, making it significantly more expensive for industry to operate and squeezing profits. It has also caused an increase in household utility bills. The importing of so much LNG has also caused Japan to begin posting trade deficits, something unheard of prior to the shutting down of all of the nuclear reactors. Presently there are 25 reactors in Japan that are seeking a restart and the government, led by Prime Minister Shinzo Abe, wants to start as many as possible “to meet the nation’s energy needs and grow the economy.” ( source ) The restarting of Japan’s nuclear reactors should have a positive impact on the price of uranium. The psychological barrier to investing in the sector that shutting down its reactors caused will be removed and this should be bullish for the price. The restarts will also boost the confidence of investors in the industry as a whole and the long-term prospects for the nuclear power industry. Although Germany is planning to decommission all of its nuclear power plants by 2020, there is a real fear by taxpayers in the country that they will have to foot the bill for the increase in prices that are going to be an inevitable cost of shuttering the nuclear power industry. So, will Germany reverse course and eventually go back to using nuclear energy or power generation? Time will tell, but even the country does get completely out of nuclear power generation, it really won’t have any negative impact on the inevitable rise in prices ahead. This is because of the Asian move towards nuclear energy to meet the massive need for power in that area of the world, home to 4.47 billion people. In East through to South Asia, there are currently 123 operating nuclear power reactors, 41 under construction and firm plans to build 92 more, while many more are proposed. The greatest growth in nuclear power generation is expected in China, South Korea and India. ( source ) How To Invest In The Sector Aside from investing in individual uranium mining and processing companies, some of which I will highlight in my next article on this subject, one way to invest in this sector is through the Global X Uranium ETF (NYSEARCA: URA ). See the chart below. (click to enlarge) URA tracks the Solactive Global Uranium Index and both the index and the ETF include companies involved in the exploration, mining, and harnessing of uranium. Some of the top holdings include Cameco Corp. (NYSE: CCJ ), Uranium One (TSE-UUU), and Hathor Exploration (TSX-HAT). You can see from the chart above that the ETF has seen its price decimated by the melt down (pun intended) in the sector since 2011 and the fall in the price of uranium, which currently sits at a spot price of Nevertheless, for contrarions, this presents a great time to consider investing some funds in this space, especially as the uranium price, currently sitting at approximately $36/pound, is bound to begin rising in response to the inevitable demand/supply imbalance created by the need for more and more affordable and clean energy sources, especially in Asia. Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in URA over the next 72 hours. (More…) I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. Scalper1 News

Scalper1 News