Though he campaigned for Hillary Clinton, financier Warren Buffett ( Trades , Portfolio ) divulged that he bought a lot of stocks following the election of President Donald Trump, and on Tuesday he revealed what they were.

The CEO of Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) started three new positions, in Southwest Airlines Co. ( LUV ), Monsanto Co. ( MON ) and Sirius XM Holdings ( SIRI ). He (or one of his managers, Ted Weschler and Todd Combs) also continued his liking for airlines, amassing more shares of Delta Air Lines Inc. ( DAL ), United Continental Holdings Inc. ( UAL ) and American Airlines Group Inc. (AAL).

Berkshire’s other increases were to Apple Inc. (AAPL) and Bank of New York Mellon (BK).

Stocks Buffett sold were: Liberty Media Group (FWONA), Lee Enterprises Inc. (LEE), Kinder Morgan Inc. (KMI), Liberty Media Group (FWONK), Now Inc. (DNOW), Deere & Co. (DE). He sold all but 0.01% of Verizon (VZ) and slashed Wal-Mart Stores (WMT) by 89.26%.

Berkshire’s New Buys

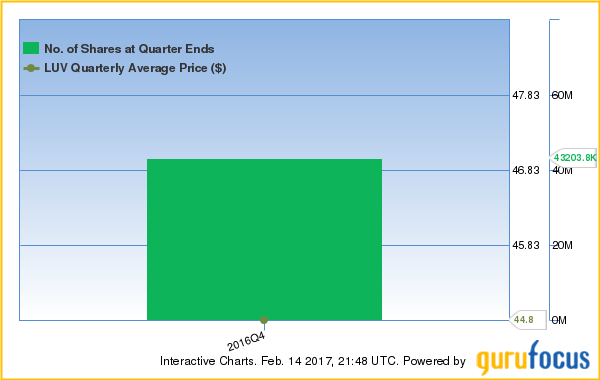

Southwest Airlines ( LUV )

Berkshire bought 43,203,775 shares of Southwest Airlines, which traded at an average price around $ 45 for the quarter. It had a 1.46% portfolio weight.

Southwest Airlines has a market cap of $ 34.03 billion; its shares were traded around $ 55.31 with a P/E ratio of 15.61 and P/S ratio of 1.72. The trailing 12-month dividend yield of Southwest Airlines stocks is 0.68%. The forward dividend yield of Southwest Airlines stocks is 0.72%. Southwest Airlines had an annual average earnings growth of 16.70% over the past 10 years.

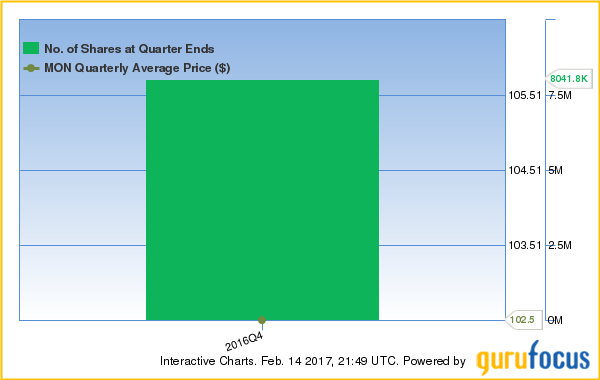

Monsanto Co. ( MON )

Berkshire bought 8,041,784 shares of Monsanto, which traded around $ 103 per share in the quarter. It has a 0.57% portfolio weight.

Monsanto has a market cap of $ 47.2 billion; its shares were traded around $ 107.63 with a P/E ratio of 29.09 and P/S ratio of 3.42. The trailing 12-month dividend yield of Monsanto stocks is 2.01%. The forward dividend yield of Monsanto stocks is 2.01%. Monsanto had an annual average earnings growth of 9.40% over the past 10 years. GuruFocus rated Monsanto the business predictability rank of 3.5-star.

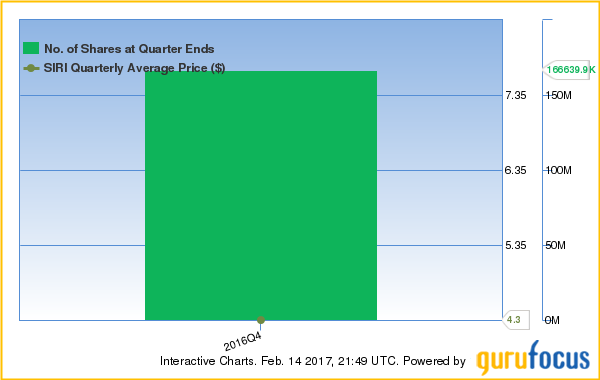

Sirius XM Holdings ( SIRI )

Berkshire bought 166,638,941 shares of Sirius XM Holdings, which had an average price around $ 4 for the quarter. It had a 0.5% portfolio weight.

Sirius XM Holdings has a market cap of $ 22.35 billion; its shares were traded around $ 4.74 with a P/E ratio of 33.86 and P/S ratio of 4.72. The trailing 12-month dividend yield of Sirius XM Holdings stocks is 0.42%. The forward dividend yield of Sirius XM Holdings stocks is 0.84%. Sirius XM Holdings had an annual average earnings growth of 18.90% over the past five years.

See Buffett’s portfolio here. Follow the author on twitter here.

This article first appeared on GuruFocus .

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International