ETF Stats For July 2015 – Currency Hedging Jumps The Shark

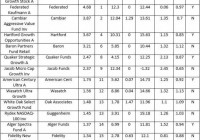

Thirty-seven new ETFs and ETNs were launched in July and fifteen closed. The changes leave the listed count at 1,764, consisting of 1,570 ETFs and 194 ETNs. With sixteen new currency-hedged ETFs coming to market, including three half-hedged funds, it would be easy to conclude that a bubble in currency-hedged ETFs exists. The first currency-hedged ETF arrived in 2006 with little fanfare. Four-and-a-half years later at the end of 2010, there were only two such products. Then, as the US Dollar started to rally, sponsors brought out a dozen more currency-hedged ETFs over the next three years. Then, the flood gates opened. Sponsors unleashed 14 currency-hedged ETFs in 2014 and 28 so far this year, with sixteen arriving in July. Today, there are 57 currency-hedged ETFs. In July, BlackRock (NYSE: BLK ) rolled out 12 new currency-hedged fund-of-funds under the iShares brand. These ETFs simply hold the unhedged-international ETFs that have been around for years and then overlay a currency hedge, which essentially shorts the foreign currency through the use of currency forwards. The most popular iShares international ETFs are now available in two versions: traditional unhedged and 100% currency hedged. Anyone following currencies knows there are periods when the US Dollar is trending stronger against other currencies and periods when the opposite is true. There are times to hedge and there are times to not hedge. Index IQ released a white paper stating its case for a 50% currency hedge . It concluded that a 50% hedge was the hedge of least regret. Index IQ launched three new international ETFs in July with a static 50% currency hedge. Others looking at the Index IQ data might conclude that a 60/40 ratio is optimal for one currency and a 43/57 split might be better for another. The possible combinations are endless. In my opinion, the iShares solution is the better one – give investors both unhedged and 100% hedged ETFs and let them tailor their own hedge ratio. The quantity of ETNs listed for trading has dropped below 200 for the first time since October 2011. The number of ETNs peaked at 218 in August 2012 and now stands at 194. Investors have consistently preferred ETFs over ETNs because ETFs do not carry the credit risk of ETNs. For the month, industry assets grew 1.4% to $2.13 trillion. The quantity of ETFs with more than $10 billion in assets increased from 50 to 54, and these 3.1% of the listings control 60% of the assets. Trading activity approached $1.6 trillion in July, and the nine ETFs that averaged more than $1 billion a day in trading accounted for the majority (52.8%) of all trading activity. July 2015 Month End ETFs ETNs Total Currently Listed U.S. 1,570 194 1,764 Listed as of 12/31/2014 1,451 211 1,662 New Introductions for Month 36 1 37 Delistings/Closures for Month 0 15 15 Net Change for Month +36 -14 +22 New Introductions 6 Months 142 5 147 New Introductions YTD 155 5 160 Delistings/Closures YTD 36 22 58 Net Change YTD +119 -17 +102 Assets Under Mgmt ($ billion) $2,109 $24.9 $2,134 % Change in Assets for Month +1.5% -8.7% +1.4% % Change in Assets YTD +6.9% -7.4% +6.7% Qty AUM > $10 Billion 54 0 54 Qty AUM > $1 Billion 263 4 263 Qty AUM > $100 Million 779 38 817 % with AUM > $100 Million 49.6% 19.6% 46.3% Monthly $ Volume ($ billion) $1,526 $61.7 $1,588 % Change in Monthly $ Volume +3.6% +14.7% +4.0% Avg Daily $ Volume > $1 Billion 8 1 9 Avg Daily $ Volume > $100 Million 87 5 92 Avg Daily $ Volume > $10 Million 307 10 317 Actively Managed ETF Count (w/ change) 133 +4 mth +8 ytd Actively Managed AUM ($ billion) $20.8 +3.0% mth +20.7% ytd Data sources: Daily prices and volume of individual ETPs from Norgate Premium Data. Fund counts and all other information compiled by Invest With An Edge. New products launched in July (sorted by launch date): ALPS Sector Leaders ETF (NYSEARCA: SLDR ), launched 7/1/15, seeks to deliver an equally weighted sector investment with a primary goal of growth and diversification. The strategy starts with the S&P 500 as its universe and then selects the five highest growth securities from each of nine sectors of the market. The holdings are equally weighted at the stock and sector level to provide diversification and avoid sector bias. SLDR has an expense ratio of 0.40%. ALPS Sector Low Volatility ETF (NYSEARCA: SLOW ), launched 7/1/15, is aimed at investors seeking to add an equally weighted sector allocation to their portfolio with goals of low volatility and diversification. The universe used is the S&P 500, and the five lowest volatility securities in each of nine sectors are selected. To provide diversification and avoid sector bias, the positions are equally weighted at both the stock and sector levels. The ETF sports an expense ratio of 0.40%. iShares Currency Hedged MSCI ACWI ETF (NYSEARCA: HACW ), launched 7/1/15, is a fund-of-funds designed to track the investment results of a global index composed of large- and mid-capitalization equities in both developed and emerging markets while mitigating exposure to fluctuations between the value of the component currencies and the US Dollar. The ETF holds the unhedged iShares MSCI ACWI ETF (NASDAQ: ACWI ) and then adds currency forwards to manage the currency risk. The expense ratio is 0.36%. iShares Currency Hedged MSCI ACWI ex U.S. ETF (NYSEARCA: HAWX ), launched 7/1/15, is a fund-of-funds seeking to track an index of international large- and mid-capitalization equities in both developed and emerging markets (excluding the US) while reducing the impact of changes between the value of the underlying currencies and the US Dollar. The ETF holds the unhedged iShares MSCI ACWI EX US ETF (NASDAQ: ACWX ) and then adds currency forwards to manage the currency risk. Investors will pay 0.36% annually to own this fund. iShares Currency Hedged MSCI Australia ETF (NYSEARCA: HAUD ), launched 7/1/15, is a fund-of-funds investing in large- and mid-capitalization Australian equities while hedging exposure to the Australian Dollar. The ETF holds the unhedged iShares MSCI Australia ETF (NYSEARCA: EWA ) and then adds currency forwards to manage the currency risk. HAUD has an expense ratio of 0.51%. iShares Currency Hedged MSCI Canada ETF (NYSEARCA: HEWC ), launched 7/1/15, is a fund-of-funds seeking to track an index of Canadian large- and mid-capitalization stocks while reducing the impact of changes in value of the Canadian Dollar. The ETF holds the unhedged iShares MSCI Canada ETF (NYSEARCA: EWC ) and then manages the currency risk with forwards. The expense ratio is 0.51%. iShares Currency Hedged MSCI EAFE Small-Cap ETF (NYSEARCA: HSCZ ), launched 7/1/15, is a fund-of-funds investing in small-capitalization equities from developed markets, excluding the US and Canada, while mitigating the impact of fluctuations between the value of the component currencies and the US Dollar. The ETF holds the unhedged iShares MSCI EAFE Small-Cap ETF (NYSEARCA: SCZ ) and then adds currency forwards to manage the currency risk. The ETF sports an expense ratio of 0.43%. iShares Currency Hedged MSCI Italy ETF (NYSEARCA: HEWI ), launched 7/1/15, is a fund-of-funds designed to track large- and mid-capitalization Italian equities while hedging exposure to value fluctuations between the Euro and the US Dollar. The ETF holds the unhedged iShares MSCI Italy Capped ETF (NYSEARCA: EWI ) and then adds currency forwards to manage the currency risk. Investors will pay 0.48% annually to own this ETF. iShares Currency Hedged MSCI Mexico ETF (NYSEARCA: HEWW ), launched 7/1/15 is a fund-of-funds investing in Mexican large- and mid-capitalization stocks while hedging exposure to changes in value of the Mexican Peso. The ETF holds the unhedged iShares MSCI Mexico Capped ETF (NYSEARCA: EWW ) and then manages the currency risk with forwards. HEWW has an expense ratio of 0.51%. iShares Currency Hedged MSCI South Korea ETF (NYSEARCA: HEWY ), launched 7/1/15, is a fund-of-funds designed to track large- and mid-capitalization South Korean equities while mitigating exposure to fluctuations in the South Korean Won. The ETF holds the unhedged iShares MSCI South Korea Capped ETF (NYSEARCA: EWY ) and then adds currency forwards to manage the currency risk. The expense ratio is 0.62%. iShares Currency Hedged MSCI Switzerland ETF (NYSEARCA: HEWL ), launched 7/1/15, is a fund-of-funds seeking to track an index of Swiss large- and mid-capitalization equities while reducing the impact of changes in value between the Swiss Franc and the US Dollar. The ETF holds the unhedged iShares MSCI Switzerland Capped ETF (NYSEARCA: EWL ) and then manages the currency risk with forwards. The ETF sports an expense ratio of 0.51%. iShares Currency Hedged MSCI Spain ETF (NYSEARCA: HEWP ), launched 7/1/15, is a fund-of-funds seeking to track an index of Spanish large- and mid-capitalization equities while hedging exposure to changes in value between the Euro and the US Dollar. The ETF holds the unhedged iShares MSCI Spain Capped ETF (NYSEARCA: EWP ) and then manages the currency risk with forwards. Investors will pay 0.51% annually to own this fund. iShares Currency Hedged MSCI United Kingdom ETF (NYSEARCA: HEWU ), launched 7/1/15, is a fund-of-funds investing in large- and mid-capitalization United Kingdom equities while reducing the impact of value fluctuations between the British Pound and the US Dollar. The ETF holds the unhedged iShares MSCI United Kingdom ETF (NYSEARCA: EWU ) and then adds currency forwards to manage the currency risk. HEWU has an expense ratio of 0.48%. ALPS Enhanced Put Write Strategy ETF (NYSEARCA: PUTX ), launched 7/7/15, is an actively managed ETF seeking total return, but with an emphasis on income as the source of that total return. The strategy is to sell listed one-month put options on the SPDR S&P 500 ETF (NYSEARCA: SPY ) and invest the proceeds in a portfolio of investment grade debt securities. The expense ratio is 0.75%. First Trust NASDAQ CEA Cybersecurity ETF (NASDAQ: CIBR ), launched 7/7/15, focuses on companies engaged in the cybersecurity segment of the technology and industrials sectors. Component companies are involved in the building, implementation, and management of security protocols in an attempt to provide protection of the integrity of data and network operations for private and public networks, computers, and mobile devices. The ETF sports an expense ratio of 0.60%. Compass EMP US Large Cap High Dividend 100 Volatility Weighted Index ETF (CDL), launched 7/8/15, will invest in the common stock of the 100 highest dividend yielding stocks in a universe of the 500 largest US companies. To be selected, a company must have positive earnings in each of the four most recent quarters. Securities are weighted based on their volatility, with lower readings resulting in higher weights. The ETF’s expense ratio will be capped at 0.35% until June 30, 2017. Compass EMP US Small Cap 500 Volatility Weighted Index ETF (NASDAQ: CFA ), launched 7/8/15, takes volatility-weighted positions in the largest 500 US companies whose market capitalization is less than $3 billion. To be eligible, a company must have positive earnings in each of the four most recent quarters. Volatility is measured utilizing daily prices changes over the past 180 days, and securities are ranked on that criteria. The ETF’s expense ratio will be capped at 0.35% until June 30, 2017. Compass EMP US Small Cap High Dividend 100 Volatility Weighted Index ETF (CSB), launched 7/8/15, selects 100 of the highest dividend yielding stocks from among the 500 largest US companies with a market capitalization of less than $3 billion. Only companies with positive earnings in each of the four most recent quarters will be considered. Weightings are determined based on each security’s volatility. The ETF’s expense ratio will be capped at 0.35% until June 30, 2017. GaveKal Knowledge Leaders Developed World ETF (NYSEARCA: KLDW ), launched 7/8/15, seeks to transform Gavekal’s concept of the Knowledge Effect into portfolio alpha utilizing companies in developed markets. The Knowledge Effect is the propensity of innovative companies to experience excess returns, resulting from the inability of investors to adequately evaluate companies that invest heavily in producing knowledge. The strategy attempts to capture this market inefficiency using a proprietary methodology which capitalizes corporate knowledge investments, measures firm performance on a knowledge-adjusted basis, and selects investments on the basis of knowledge intensity. The ETF sports an expense ratio of 0.75%. GaveKal Knowledge Leaders Emerging Markets ETF (NYSEARCA: KLEM ), launched 7/8/15, is designed to translate Gavekal’s concept of the Knowledge Effect into gains for investors utilizing equities in emerging markets. The Knowledge Effect is the propensity of innovative companies to experience excess returns, resulting from the inability of investors to correctly evaluate companies that invest heavily in producing knowledge. The strategy attempts to capture this market inefficiency by using a selection model that adjusts each company’s reported financial data by treating intangible investments (items such as research and development, brand development, and employee training expenses) identical to tangible investments. Investors will pay 0.95% annually to own this fund. Principal EDGE Active Income ETF (NYSEARCA: YLD ), launched 7/9/15, is an actively managed fund seeking to provide current income by investing in six income-producing asset classes. Holdings will be allocated among equities and fixed income securities (both investment grade and non-investment grade) domiciled across the world, including emerging markets. No yield information is provided. The expense ratio will be capped at 0.85% until 10/31/16. WisdomTree Barclays U.S. Aggregate Bond Enhanced Yield Fund (AGGY), launched 7/9/15, has a strategy to divide the Barclays US Aggregate Bond Index into 20 subcomponents and then allocate among them to produce more yield while keeping risk characteristics similar to the index. Average yield to maturity is currently about 3.0%. AGGY will cap its expense ratio at 0.12% until December 31, 2016. WisdomTree International Hedged Equity Fund (HDWM), launched 7/9/15, will provide exposure to dividend-paying companies in 21 developed countries, the US and Canada are excluded, while hedging exposure to fluctuations between the US Dollar and foreign currencies. The United Kingdom currently has the highest allocation at 23.3%, with Japan coming in next at 14.2%. Weightings are determined by annual dividends. The ETF sports an expense ratio of 0.35%. Global X SuperDividend Alternatives ETF (NASDAQ: ALTY ), launched 7/14/15, is designed to give investors access to alternative investments that generate high income. The ETF looks for opportunities among the highest dividend yielding securities in a variety of alternative investment classes, such as MLPs, infrastructure companies, REITs, mortgage REITs, emerging market debt, currency trading, business development companies (“BDCs”), private equity, asset and mortgage backed securities, and option-writing strategies. The strategy may utilize a fund-of-fund approach and has a current allocation of about 25% to Global X SuperDividend REIT ETF. ALTY leads all the other introductions this month with a very high expense ratio of 3.03% (0.75% management fee + 2.28% acquired fund fees). Market Vectors Morningstar International Moat ETF (NYSEARCA: MOTI ), launched 7/14/15, invests equal weights in 50 non-US companies that Morningstar’s equity research team believes are attractively priced and have sustainable competitive advantages for at least 10-20 years. A momentum screen is used to exclude the bottom 20% of universe securities with the worst 12-month momentum scores. Equities are selected by ranking the ratio of the issuer’s stock price to a modified price determined by a proprietary valuation model. The expense ratio is capped at 0.56% until 2/1/17. O’Shares FTSE U.S. Quality Dividend ETF (NYSEARCA: OUSA ), launched 7/14/15, selects the stocks of large- and mid-capitalization dividend-paying companies in the US that meet certain requirements for quality, low volatility, and dividend yield. The high quality and low volatility requirements are intended to help avoid equities that have undergone significant declines in price. OUSA currently holds 142 securities with the largest sector weightings in consumer goods and health care at around 17% each. Investors will pay 0.48% annually to own this fund. ETRACS 2xMonthly Leveraged S&P MLP Index ETN (MLPV), launched 7/15/15, is an exchange traded note linked to the monthly compounded 2x (200%) leveraged performance of a group of master limited partnerships (MLPs) and publicly traded limited liability companies (LLCs) engaged in aspects of the mining, production, storage, or transportation of mineral or natural resources. Current annual yield is about 11.5%, with coupon payments expected quarterly. MLPV has an expense ratio of 0.95%. PureFunds ISE Big Data ETF ( BDAT ), launched 7/16/15, provides the market with exposure to companies engaged in big data and analytics. These companies generate products and services that allow for the creation, management, and analysis of data sets that are very large (volume), diverse (variety), or rapidly generated and integrated (velocity). Not surprisingly, Google tops the holdings list at 7.3%. The ETF sports an expense ratio of 0.75%. PureFunds ISE Mobile Payments ETF ( IPAY ), launched 7/16/15, was created to give investors an easy method to focus on companies in the mobile payments industry. Sub-segments represented include credit card networks, infrastructure and software, processors, and solution providers. Visa, MasterCard, American Express, and PayPal top the holdings list at around 6% each. IPAY’s expense ratio is 0.75%. WisdomTree Strong Dollar U.S. Equity Fund (USSD), launched 7/21/15, seeks to invest in US companies that derive more than 80% of their revenue from within the country’s borders in an effort to minimize exposure to companies with significant revenue from exports that are vulnerable to a strengthening US Dollar. The strategy attempts to further that goal by biasing the weighing process to companies with a higher correlation to the US Dollar. Investors will pay 0.33% annually to own this ETF. WisdomTree Weak Dollar U.S. Equity Fund (USWD), launched 7/21/15, invests in US companies that derive less than 60% of their revenue from within the country’s borders in an effort to maximize exposure to companies with significant revenue from exports that are more likely to benefit from a weakening US Dollar. The strategy attempts to further that goal by tilting the weighing process to companies with a lower (more negative) correlation to the US Dollar. USWD has an expense ratio of 0.33%. IQ 50 Percent Hedged FTSE Europe ETF (NYSEARCA: HFXE ), launched 7/22/15, purchases large- and mid-capitalization equities in developed European countries and then hedges against about half of the risk associated with fluctuations in the value of the component currencies and the US Dollar. United Kingdom leads the country allocation at 32%, and the top sector is financials at 23%. The ETF sports an expense ratio of 0.45%. IQ 50 Percent Hedged FTSE International ETF (NYSEARCA: HFXI ), launched 7/22/15, invests in large- and mid-capitalization equities in developed countries, excluding North America, and then hedges against 50% of the changes in value between the underlying currencies and the US Dollar. Japan is on top of the country allocations at 23%, and financials leads the sector allocation at 25%. HFXI’s expense ratio is 0.35%. IQ 50 Percent Hedged FTSE Japan ETF (NYSEARCA: HFXJ ), launched 7/22/15, buys Japanese equity securities of large- and mid-capitalization companies and then reduces the exposure to rate changes between the Japanese Yen and US Dollar to about half. Consumer goods (24%) and industrials (21%) lead the sector allocations. Investors will pay 0.45% annually to own this ETF. iShares Interest Rate Hedged 10+ Year Credit Bond ETF (NYSEARCA: CLYH ), launched 7/23/15, is an actively managed find-of-funds seeking to provide exposure to long-term US investment grade bonds while mitigating interest rate risk. The ETF will hold iShares 10+ Year Credit Bond ETF (NYSEARCA: CLY ) to represent its bond investments, and then take short positions in interest rate swaps to manage the interest rate risk. The yield is currently listed at 2.39%. The expense ratio will be capped at 0.30% until February 28, 2017. iShares Interest Rate Hedged Emerging Markets Bond ETF (NYSEARCA: EMBH ), launched 7/23/15, is an actively managed fund-of-funds with an objective of providing investors access to emerging market bonds while reducing the interest rate risk. The fund will hold US Dollar-denominated, emerging market bonds by purchasing iShares JPMorgan USD Emerging Markets Bond ETF (NYSEARCA: EMB ), and subsequently shorting interest rate swaps to help control the interest rate risk. The expense ratio is capped at 0.50% until February 28, 2017. iShares Currency Hedged Global ex USD High Yield Bond ETF (NYSEARCA: HHYX ), launched 7/30/15, is a fund-of-funds designed to give investors access to Euro, British Pound, and Canadian Dollar denominated, high yield corporate bonds while mitigating exposure to fluctuations between the value of the component currencies and the US Dollar. The ETF will hold iShares Global ex-USD High Yield Bond ETF (BATS: HYXU ) and purchase forwards to manage the currency risk aspect. Yield is currently posted at 3.75%, and the expense ratio is 0.43%. Product closures/delistings in July: CS X-Links 2x Monthly Merger Arbitrage ETN (NYSEARCA: CSMB ) CS X-Links HOLT Market Neutral Global Equity ETN (NYSEARCA: CSMN ) RBS China Trendpilot ETN (NYSEARCA: TCHI ) RBS Global Big Pharma ETN (NYSEARCA: DRGS ) RBS Gold Trendpilot ETN (NYSEARCA: TBAR ) RBS NASDAQ 100 Trendpilot ETN (TBDQ) RBS Oil Trendpilot ETN (NYSEARCA: TWTI ) RBS Rogers Enhanced Agriculture ETN (NYSEARCA: RGRA ) RBS Rogers Enhanced Commodity Index ETN (NYSEARCA: RGRC ) RBS Rogers Enhanced Energy ETN (NYSEARCA: RGRE ) RBS Rogers Enhanced Industrial Metals ETN (NYSEARCA: RGRI ) RBS Rogers Enhanced Precious Metals ETN (NYSEARCA: RGRP ) RBS US Large Cap Alternator ETN (NYSEARCA: ALTL ) RBS US Large Cap Trendpilot ETN (NYSEARCA: TRND ) RBS US Mid Cap Trendpilot ETN (NYSEARCA: TRNM ) Product changes in July: WisdomTree China ex-Financials Fund (NASDAQ: CHXF ) underwent an extreme makeover, becoming the WisdomTree China ex-State-Owned Enterprises Fund (CXSE) effective July 1 ( press release ). Deutsche X-trackers MSCI EMU Hedged Equity ETF (NYSEARCA: DBEZ ) was renamed the Deutsche X-trackers MSCI Eurozone Hedged Equity ETF ( DBEZ ) effective July 7. BlackRock, Bloomberg, State Street, Tradeweb, and leading broker dealers on July 27 announced a Market Standard Methodology for Fixed Income ETFs to enable bond buyers to calculate key metrics for fixed income ETFs. Announced Product Changes for Coming Months: AdvisorShares Accuvest Global Long/Short ETF (NYSEARCA: AGLS ) will close with its last day of trading on August 7. BlackRock will close 18 iShares ETFs with August 21 set as the last day of trading. The iShares MSCI USA ETF (NYSEARCA: EUSA ), a capitalization-weighted fund, will undergo an extreme makeover on August 31 becoming the iShares MSCI USA Equal Weighted ETF ( EUSA ). The iShares iBonds Sep 2015 AMT-Free Muni Bond ETF (NYSEARCA: IBMD ) is scheduled to mature and will cease trading after the market closes on September 1. The iShares Japan large-Cap ETF (NYSEARCA: ITF ), based on the S&P/TOPIX 150 Index, will undergo an extreme makeover on September 4 becoming the iShares JPX-Nikkei 400 ETF ( ITF ). Direxion will perform reverse splits on six of its leveraged ETFs effective September 10. ProShares UltraShort Telecommunications (NYSEARCA: TLL ) will close with its last day of trading being September 14. Van Eck Global plans to acquire Yorkville MLP ETFs ( press release ) and hopes to close the transaction in the fourth quarter. Previous monthly ETF statistics reports are available here . Disclosure covering writer: No positions in any of the securities mentioned. No positions in any of the companies or ETF sponsors mentioned. No income, revenue, or other compensation (either directly or indirectly) received from, or on behalf of, any of the companies or ETF sponsors mentioned. Share this article with a colleague