On Jan 16, we issued an updated research report on fertilizer company CF Industries CF .

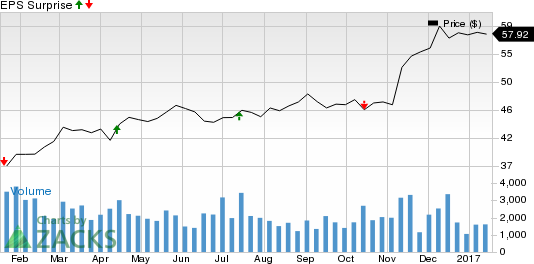

CF Industries has outperformed the Zacks categorized Fertilizers industry in the past three months, aided by its forecast-topping earnings performance in the last quarter and efforts to boost production capacity. The company’s shares have gained around 50.4% over this period, compared with roughly 23.1% gain recorded by the industry.

CF Industries is well placed to gain from its efforts to expand production capacity. The company has completed its capacity expansion projects which should drive its growth and increase its cash generation capability.

The company, in late 2016, announced the completion of its capacity expansion projects, with the successful start of new ammonia and urea plants at its Port Neal, IA, Nitrogen Complex.

The annual gross ammonia capacity at Port Neal now stands at 1.2 million tons, higher than the previous capacity of 380,000 tons. Output from the new ammonia capacity is expected to be mostly upgraded to urea. The total annual urea capacity at the facility is now 1.4 million tons, up from the previous capacity of 50,000 tons. Total annual urea ammonium nitrate (“UAN”) capacity remains stable at 800,000 tons.

CF Industries is also expected to benefit from higher nitrogen demand driven by healthy U.S. corn plantations. Notwithstanding the current oversupply in the industry, the company sees global nitrogen demand to grow roughly 2% annually. The company has built a strong UAN order book.

However, CF Industries continues to see pricing pressure. Depressed global energy prices and excess capacity have contributed to a softer nitrogen pricing environment. Global capacity expansion continues to exert pressure on urea and other nitrogen fertilizer prices.

Nitrogen prices are expected to remain under pressure in the near term due to elevated supply. Abundant nitrogen supply driven by new production capacity is expected weigh on global prices in 2017. Additional urea and UAN production capacity is slated to come on stream in North America in the first or second quarter of 2017.

CF Industries also has a debt-laden balance sheet with long-term debt of roughly $ 5.5 billion at the end of the third quarter of 2016. The company also faces intense pricing competition from both domestic and foreign fertilizer producers and volatility in raw material costs.

CF Industries currently carries a Zacks Rank #3 (Hold).

CF Industries Holdings, Inc. Price

CF Industries Holdings, Inc. Price | CF Industries Holdings, Inc. Quote

Stocks to Consider

Better-ranked companies in the basic materials space include The Chemours Company CC , Methanex Corporation MEOH and Kronos Worldwide, Inc. KRO , all holding a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Chemours has an expected long-term growth of 15.5%.

Methanex has an expected long-term growth of 15%.

Kronos has an expected long-term growth of 5%.

Zacks’ Top 10 Stocks for 2017

In addition to the stocks discussed above, would you like to know about our 10 finest tickers for the entirety of 2017?

Who wouldn’t? These 10 are painstakingly hand-picked from 4,400 companies covered by the Zacks Rank. They are our primary picks to buy and hold. Be among the very first to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Methanex Corporation (MEOH): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Chemours Company (The) (CC): Free Stock Analysis Report

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Plantations International