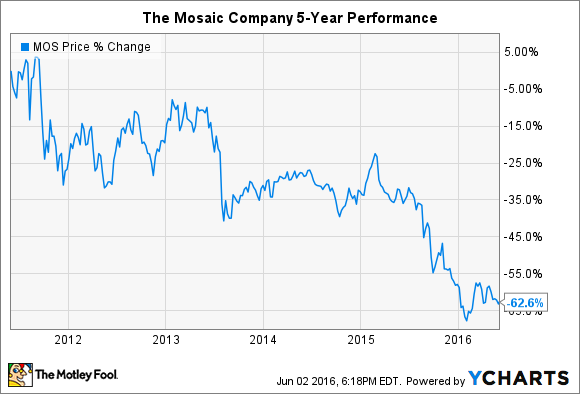

< div id =" articleText" legibility=" 117.60514824178" > Picture resource: Greg Clarke/< a href=" https://www.flickr.com/photos/leppre/9678070427/" rel=" nofollow" > Flickr. Fertilizer shares present an interesting option for clients. On one hand, your expenditure premise can be as easy as examining worldwide population development, and concluding that agrarian nutrients will be actually essential to permitting raised food items manufacturing. On the contrary, the field cannot seem to be to discover its own ground, with every tip of positive outlook seemingly being actually overwhelmed through complicated and promptly altering market disorders in the last few years. Stubbornly constant headwinds are actually definitely shown in the latest performance from The Mosaic Business (NYSE: MONTHS) share, which is down 63% in the final 5 years: < a href=" http://ycharts.com/companies/MOS/chart/" rel=" nofollow" >< img course

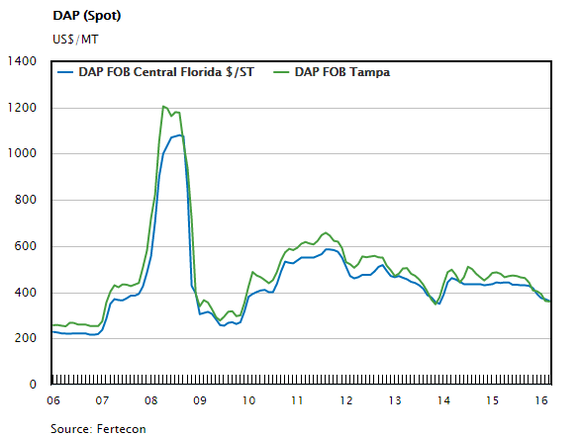

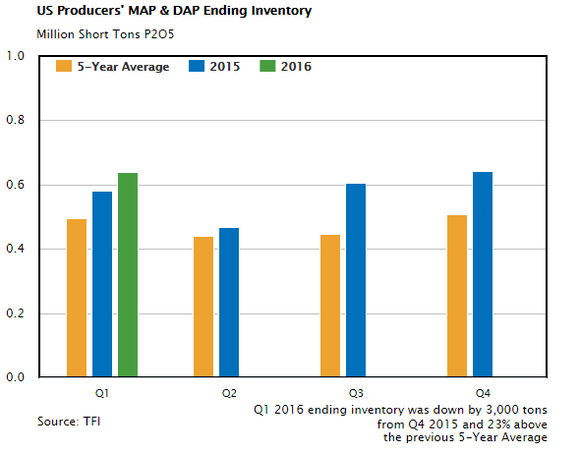

=” articleImgLg “alt =” MOS Chart” src=” https://www.scalper1.com/wp-content/uploads/2016/06/c3b72d6fb8018cdd0ebd09af38d8ea9e.png “/ >< a href=" http://ycharts.com/companies/MOS" rel= "nofollow "> MOS records through< a href =" http://ycharts.com/" rel=" nofollow" > YCharts. While markets for the three main farming nutrients– potash, phosphate, and nitrogen– are going to likely support ultimately, clients could desire to stay mindful just before guaranteeing big on a recuperation in the future. Listed below are three factors The Mosaic Provider’s stock could possibly fall, which will be actually observed by a write-up suggesting the resisting standpoint, in the following weeks. In 2015, The Variety Business created 48% of its earnings from phosphates, 26% from potash, as well as the remaining 26% off its own international distribution sector, which functions as a logistical upper arm to support interior manufacturing operations, and also to market products off other suppliers. The firm is just one of the most extensive producers of phosphate as well as potash on the planet, behind 14% as well as THIRTEEN%, specifically, from worldwide production. That’s a terrific toughness for investors when plant food markets are actually smashing– as displayed through record-high inventory prices of over $ 150 every reveal in the course of the last positive field pattern in 2008– yet it likewise burdens the provider’s functional functionality when markets are dispirited. Sadly, today’s markets are actually very clinically depressed. Phosphate (imagined below) and also potash rates are actually resting at multi-year lows, and also have continuouslied slide lesser in 2016. < img class=" articleImgLg" alt=" G" src=" https://www.scalper1.com/wp-content/uploads/2016/06/031_mos-phosphate-prices_large.png"/ > Photo resource:< a href=" http://www.potashcorp.com/customers/markets/market_data/prices/" rel=" nofollow" > PotashCorp. This has actually obliged Variety as well as various other phosphate producers to improve intensities to keep earnings levels; but that can be actually a short-sighted approach. Why? Marketing higher volumes can easily make it possible for Mosaic to protect on its own off lower marketing costs in the around term, yet this may additionally produce inflamationing stocks in longer amount of time. In the very first quarter of 2016, phosphate (rendered under) as well as potash supplies off UNITED STATE producers were significantly more than the five-year average: < img lesson=" articleImgLg" alt=" G" src=" https://www.scalper1.com/wp-content/uploads/2016/06/031_mos-phosphate-inventories_large.png"/ > Picture source:< a href=" http://www.potashcorp.com/customers/markets/market_data/phosphate_supply_demand/" rel=" nofollow" > PotashCorp. This is additionally mirrored in Variety’s SEC filings, which reveal that the Variety is actually an unusual exception, up until now making a decision to hold its own quarterly payment at an everlasting high from$ 0.28 each reveal. While the returns might be actually maintainable, investors may wish to begin entertaining the concept that administration will definitely lower the quarterly payout from vigilance, particularly provided the obstinate market shapes explained above. Just what performs it indicate for financiers? The most basic investment premise doesn’t ever verify dependable. There is actually without a doubt that agricultural nutrients will certainly have an important function in allowing improving food development

in the arriving many years; however as plant food supplies have concerned discover, factors varying from a powerful USA dollar to disheartened surface rates can clash in unpredictable means. This could be challenging to feel, yet Mosaic stock could possibly become even further prior to entrepreneurs delight in a healing. A top secret billion-dollar share chance The globe’s greatest tech firm failed to remember to show you something, but a few Commercial experts and the Fool really did not overlook a beat: There is actually a small company that is actually powering their brand-new gadgets and

Costs remain pressured

Increasing inventories

the coming change in innovation. As well as our team presume its own stock cost possesses virtually infinite area to manage for very early in-the-know clients! To become among all of them, < a href=" http://www.fool.com/mms/mark/ecap-foolcom-apple-wearable?aid=6965&source=irbeditxt0000017&ftm_cam=rb-wearable-d&ftm_pit=2692&ftm_veh=article_pitch&utm_campaign=article&utm_medium=feed&utm_source=nasdaq" rel=" nofollow" > just visit here.

The perspectives and point of views conveyed here are actually the perspectives and opinions of the written and also do not essentially reveal those of Nasdaq, Inc.&

< a rel=" nofollow" href=" http://articlefeeds.nasdaq.com/~r/nasdaq/symbols/~3/OxUDrFLn6o8/3-reasons-why-the-mosaic-companys-stock-could-fall-cm632802" > Most recent Contents Plantations International